CORRESP: A correspondence can be sent as a document with another submission type or can be sent as a separate submission.

Published on August 8, 2023

|

Chimera Investment Corporation

630 Fifth Avenue, Suite 2400

New York, New York 10111

Tel 212-626-2300

www.chimerareit.com

|

|

||||

August 8, 2023

Mr. Eric McPhee

Division of Corporation Finance

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Re: Chimera Investment Corporation

Form 10-K

Filed February 17, 2023

File No. 001-33796

Dear Mr. McPhee:

On behalf of Chimera Investment Corporation (“we”, “our” or the “Company”), set forth below is our response to the comments of the staff of the Division of Corporation Finance of the Securities and Exchange Commission, received by letter dated July 13, 2023, in which you provided comments to the reports referenced above.

For your convenience, we have reproduced your comment followed by our corresponding response.

Form 10-K for the year ended December 31, 2022

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 51

1.We note you have added transaction expenses back to GAAP Net income within your

calculation of Earnings available for distribution. Please clarify for us the nature of these

expenses. In addition, please tell us, and revise your filing to disclose, why management

believes the exclusion of these expenses provides useful information to investors. Refer

to Item 10(e) of Regulation S-K.

Response:

Transaction costs are costs associated with our securitization platform, as well as other costs associated with transactions that are similar to securitizations done by Chimera Investment Corp from time to time such as structured financing arrangements. These costs are incurred at the time of the transaction and include underwriting fees, legal costs, diligence fees and other transaction-related expenses. Ongoing costs of operating the securitizations such as servicing fees, custodial fees, trustee fees and other similar ongoing fees are not transaction costs and are not excluded from earnings available for distribution.

Our activity in the securitization structured finance market varies significantly period to period with some periods having significant activity and others with little to no activity. Due to this volatility, the expenses we incur from these transactions can confuse investors trying to compare our performance between periods and as a result can make performance measures that include these costs less meaningful. This drove our management’s decision to exclude these costs in our internal management reviews of Company performance beginning in 2019. Consistent with management’s treatment of these costs for purposes of evaluating performance, beginning in the

|

Chimera Investment Corporation

630 Fifth Avenue, Suite 2400

New York, New York 10111

Tel 212-626-2300

www.chimerareit.com

|

|

||||

second quarter of 2019 we began excluding these costs from our non-GAAP performance measure “Earnings Available for Distribution” (EAD), formerly Core Income. We made this change because we thought it was important for investors to be able to evaluate Company returns on the same basis as management and in response to investor and analyst confusion about the period-to-period variability in our EAD that was generally attributable to these transaction costs, confusion that was exacerbated by the fact that most of our peers were backing out these transaction costs from their non-GAAP measures.

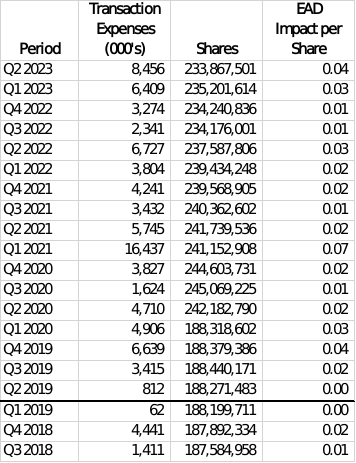

The table below illustrates the fluctuations in our EAD due to transaction expenses:

As you can see, these costs ranged from $62,000 (essentially no EAD effect per diluted share) to $16.4 million ($0.07 per diluted share reduction of EAD) which reflected a post-COVID backlog of transactions. The effect averaged approximately $0.02 per share over the periods above.

In addition, we have elected the fair value option for all our secured debt issued since 2015. GAAP accounting rules require that these transaction costs are expensed due to our fair value option election. If we had not made the fair value option election, most of these transaction costs would be capitalized and amortized as an adjustment to yield over the life of the financial instrument. In reviewing our peers’ disclosures, we noted that many also exclude transaction expenses from their non-GAAP performance measures and, in some cases, reference the GAAP

|

Chimera Investment Corporation

630 Fifth Avenue, Suite 2400

New York, New York 10111

Tel 212-626-2300

www.chimerareit.com

|

|

||||

accounting fair value option election as a key reason why they exclude these costs. In addition, tax accounting, which is a portion of our EAD considerations, capitalize and amortize applicable deal costs, therefore, the tax portion of our dividend considerations does not immediately expense these transaction expenses when these costs are consolidated for tax.

As disclosed in our Form 10-K, we view EAD as one measure of our investment portfolio’s ability to generate income which can support our ability to pay distributions to common stockholders. In addition, our Board of Directors considers EAD, among other things, in setting our dividend policy. We try to set our dividend based on our expectations of normalized EAD period to period without the variability transaction expenses would introduce. We believe EAD, with the transaction expense adjustment described above, is useful to investors in evaluating our period-to-period earnings generating capacity. However, we consistently caution investors that EAD is not a proxy for REIT taxable income or the amount of dividends we may pay and should not be viewed in isolation or as a substitute for GAAP net income and is one of several things the Board considers in setting our dividend policy.

In summary, we think our current presentation of EAD is useful because EAD, when presented supplementally to GAAP net income (which does not exclude these transaction costs), allows investors to evaluate our performance across periods in the same manner management does and provides a useful measure of our investment portfolio's ability to generate income which can support our ability to pay distributions to common stockholders.

In response to your comment, and in order to assist investors with better understanding why EAD (with the transaction expense adjustment) is useful, we have updated our EAD disclosures beginning with the June 30, 2023, Form 10-Q filed on August 3, 2023 to provide more discussion of the nature of the excluded transaction expenses.

In addition, in future Exchange Act periodic reports we will expand our disclosure regarding the usefulness of the measure consistent with the above discussion.

* * * * *

If you should have any questions regarding the above or require further information, please do not hesitate to contact me at 212-626-2300.

Very truly yours,

/s/ Subramaniam Viswanathan

/s/ Subramaniam Viswanathan

Subramaniam Viswanathan

Chief Financial Officer

cc: Philip J. Kardis, II

Chief Executive Officer