EX-99.2

Published on May 4, 2023

INVESTOR PRESENTATION Q1 2023

DISCLAIMER 2 This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “goal” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our most recent Annual Report on Form 10-K, and any subsequent Quarterly Reports on Form 10-Q and Current Report on Form 8-K, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: our business and investment strategy; our ability to accurately forecast the payment of future dividends on our common and preferred stock, and the amount of such dividends; our ability to determine accurately the fair market value of our assets; availability of investment opportunities in real estate-related and other securities, including our valuation of potential opportunities that may arise as a result of current and future market dislocations; our expected investments; changes in the value of our investments, including negative changes resulting in margin calls related to the financing of our assets; changes in inflation, interest rates and mortgage prepayment rates; prepayments of the mortgage and other loans underlying our mortgage- backed securities, or MBS, or other asset-backed securities, or ABS; rates of default, delinquencies, forbearance, deferred payments, or decreased recovery rates on our investments; general volatility of the securities markets in which we invest; our ability to maintain existing financing arrangements and our ability to obtain future financing arrangements; our ability to effect our strategy to securitize residential mortgage loans; interest rate mismatches between our investments and our borrowings used to finance such purchases; effects of interest rate caps on our adjustable-rate investments; the degree to which our hedging strategies may or may not protect us from interest rate volatility; the impact of and changes to various government programs; the impact of and changes in governmental regulations, tax law and rates, accounting guidance, and similar matters; market trends in our industry, interest rates, the debt securities markets or the general economy; estimates relating to our ability to make distributions to our stockholders in the future; our understanding of our competition; qualified personnel; our ability to maintain our classification as a real estate investment trust, or, REIT, for U.S. federal income tax purposes; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended, or 1940 Act; our expectations regarding materiality or significance; and the effectiveness of our disclosure controls and procedures. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Chimera does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these, and other risk factors is contained in Chimera’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Chimera or matters attributable to Chimera or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. All information in this presentation is as of March 31, 2023, unless stated otherwise. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors.

CHIMERA IS A RESIDENTIAL CREDIT HYBRID MORTGAGE REIT 3 Established in 2007. Internally managed since August 2015. Total capital $2.6 billion. Chimera has distributed $6 billion to common and preferred stockholders since inception. Total preferred stock $930 million. Total leverage ratio 4.1:1 / Recourse leverage ratio 1.2:1. Residential Mortgage Loans represent a significant part of our business and growth strategy. Our Residential Mortgage Loan portfolio is comprised of Re-Performing Loans (RPLs), Non-QM & Investor Loans, Business Purpose Loans (BPLs), and Prime Jumbo Loans. Leading securitization platforms in the RPL, Investor (INV), and Prime Jumbo residential credit sectors with over $15 billion of RMBS & Loan issuance currently outstanding. Our Mission Is To Deliver Attractive, Risk-Adjusted Returns. Information is unaudited, estimated and subject to change.

2023 ACTIVITY OVERVIEW 4 Information is as of April 30,2023 and is unaudited, estimated and subject to change. (1) Upon the closing of the CIM 2023-R4 securitization. Continued focus on acquiring and securitizing residential mortgage loans. Committed to purchase $1.25 billion of diversified residential mortgage loans. 57% were Seasoned RPLs, 39% were Non-QM (DSCR) Investor Loans, and the remainder were Business Purpose Loans (BPLs). Issued $841 million in Seasoned RPL securitizations (1) and a Non-QM (DSCR) Investor Loans securitization totaling $236 million. Further implemented our call optimization strategy on CIM securitizations. We exercised the call rights and terminated six existing Seasoned RPL securitizations and issued 4 new Seasoned RPL securitizations totaling $1.24 billion. Resulted in re-capturing approximately $130 million. 2 securitizations have a 1-year call option, and 2 securitizations have a 2-year call option providing the ability to take advantage of future rate declines. Total securitizations of $2.32 billion year-to-date (1). Reduced our floating rate, recourse financing exposure by approximately $640 million (1). Eliminated RPL warehouse loan exposure (1). Decrease in recourse leverage from 1.3x in Q4 2022 to 1.1x post Q1 2023 (1). Our interest rate hedging allows us optionality to benefit from lower interest rates in the future. Interest rate swaps protect approximately 48% of our floating rate liabilities. Interest Rate Swaptions provide flexibility in an environment where rates are higher for longer.

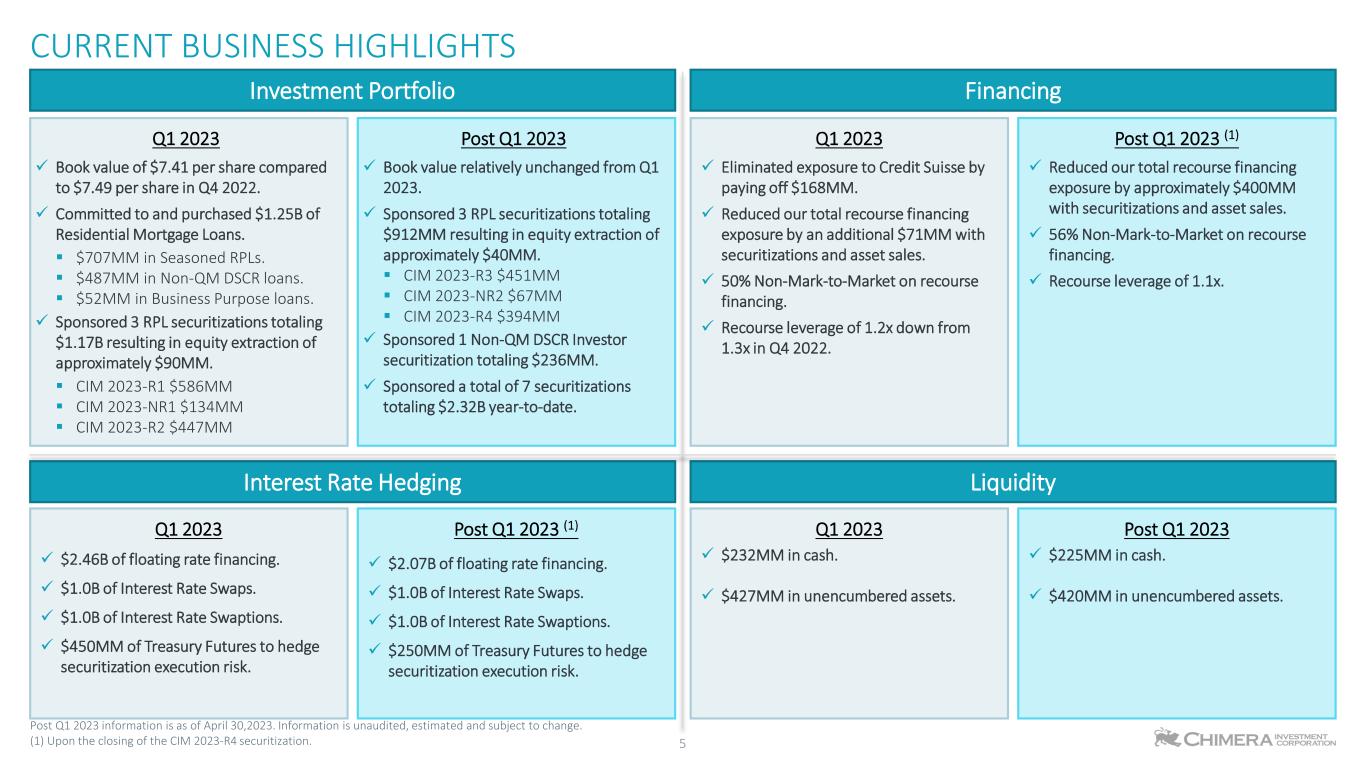

CURRENT BUSINESS HIGHLIGHTS Q1 2023 Book value of $7.41 per share compared to $7.49 per share in Q4 2022. Committed to and purchased $1.25B of Residential Mortgage Loans. $707MM in Seasoned RPLs. $487MM in Non-QM DSCR loans. $52MM in Business Purpose loans. Sponsored 3 RPL securitizations totaling $1.17B resulting in equity extraction of approximately $90MM. CIM 2023-R1 $586MM CIM 2023-NR1 $134MM CIM 2023-R2 $447MM Post Q1 2023 Book value relatively unchanged from Q1 2023. Sponsored 3 RPL securitizations totaling $912MM resulting in equity extraction of approximately $40MM. CIM 2023-R3 $451MM CIM 2023-NR2 $67MM CIM 2023-R4 $394MM Sponsored 1 Non-QM DSCR Investor securitization totaling $236MM. Sponsored a total of 7 securitizations totaling $2.32B year-to-date. Investment Portfolio Financing Q1 2023 Eliminated exposure to Credit Suisse by paying off $168MM. Reduced our total recourse financing exposure by an additional $71MM with securitizations and asset sales. 50% Non-Mark-to-Market on recourse financing. Recourse leverage of 1.2x down from 1.3x in Q4 2022. Post Q1 2023 (1) Reduced our total recourse financing exposure by approximately $400MM with securitizations and asset sales. 56% Non-Mark-to-Market on recourse financing. Recourse leverage of 1.1x. Interest Rate Hedging Q1 2023 $2.46B of floating rate financing. $1.0B of Interest Rate Swaps. $1.0B of Interest Rate Swaptions. $450MM of Treasury Futures to hedge securitization execution risk. Post Q1 2023 (1) $2.07B of floating rate financing. $1.0B of Interest Rate Swaps. $1.0B of Interest Rate Swaptions. $250MM of Treasury Futures to hedge securitization execution risk. Liquidity Q1 2023 $232MM in cash. $427MM in unencumbered assets. Post Q1 2023 $225MM in cash. $420MM in unencumbered assets. 5 Post Q1 2023 information is as of April 30,2023. Information is unaudited, estimated and subject to change. (1) Upon the closing of the CIM 2023-R4 securitization.

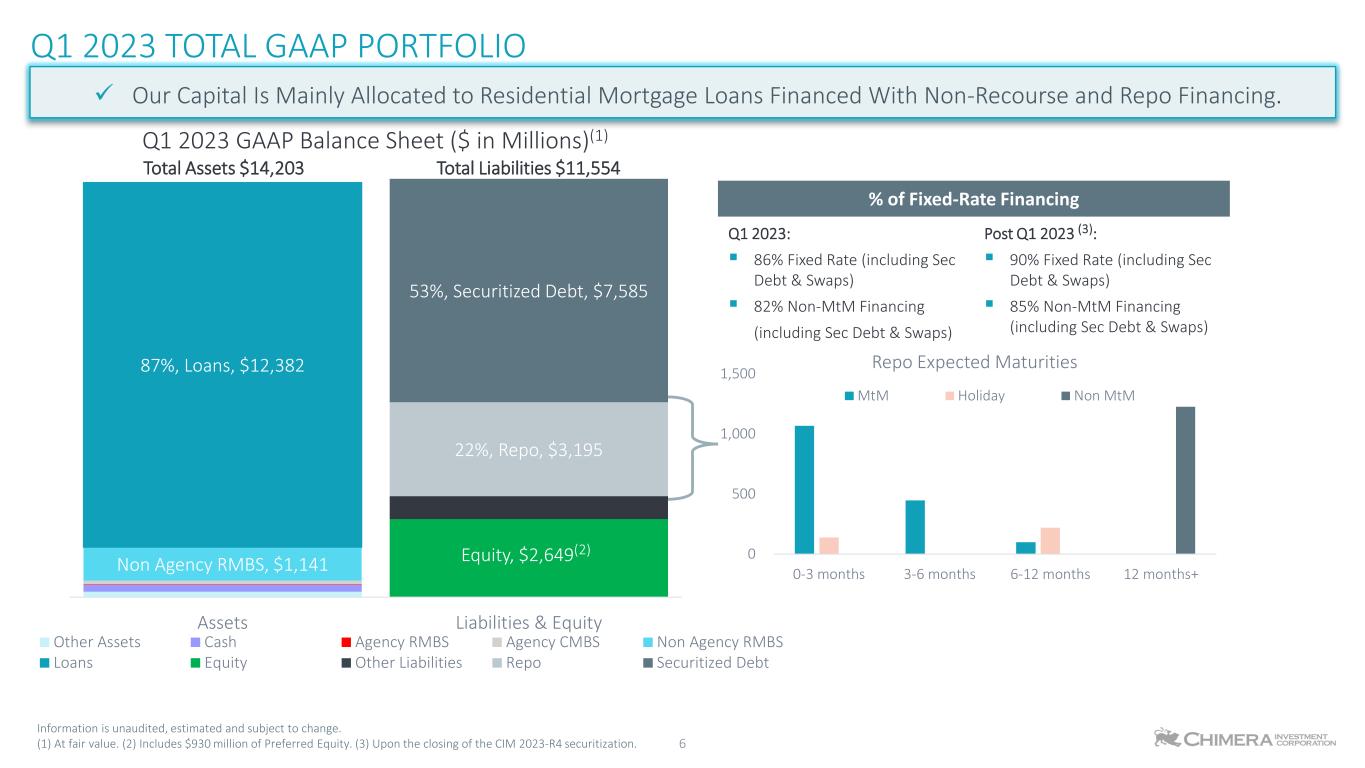

Q1 2023 TOTAL GAAP PORTFOLIO 6 Our Capital Is Mainly Allocated to Residential Mortgage Loans Financed With Non-Recourse and Repo Financing. Information is unaudited, estimated and subject to change. (1) At fair value. (2) Includes $930 million of Preferred Equity. (3) Upon the closing of the CIM 2023-R4 securitization. % of Fixed-Rate Financing Q1 2023: 86% Fixed Rate (including Sec Debt & Swaps) 82% Non-MtM Financing (including Sec Debt & Swaps) Post Q1 2023 (3): 90% Fixed Rate (including Sec Debt & Swaps) 85% Non-MtM Financing (including Sec Debt & Swaps) Non Agency RMBS, $1,141 87%, Loans, $12,382 Equity, $2,649(2) 22%, Repo, $3,195 53%, Securitized Debt, $7,585 Assets Liabilities & Equity Other Assets Cash Agency RMBS Agency CMBS Non Agency RMBS Loans Equity Other Liabilities Repo Securitized Debt Total Assets $14,203 Total Liabilities $11,554 Q1 2023 GAAP Balance Sheet ($ in Millions)(1) 0 500 1,000 1,500 0-3 months 3-6 months 6-12 months 12 months+ Repo Expected Maturities MtM Holiday Non MtM

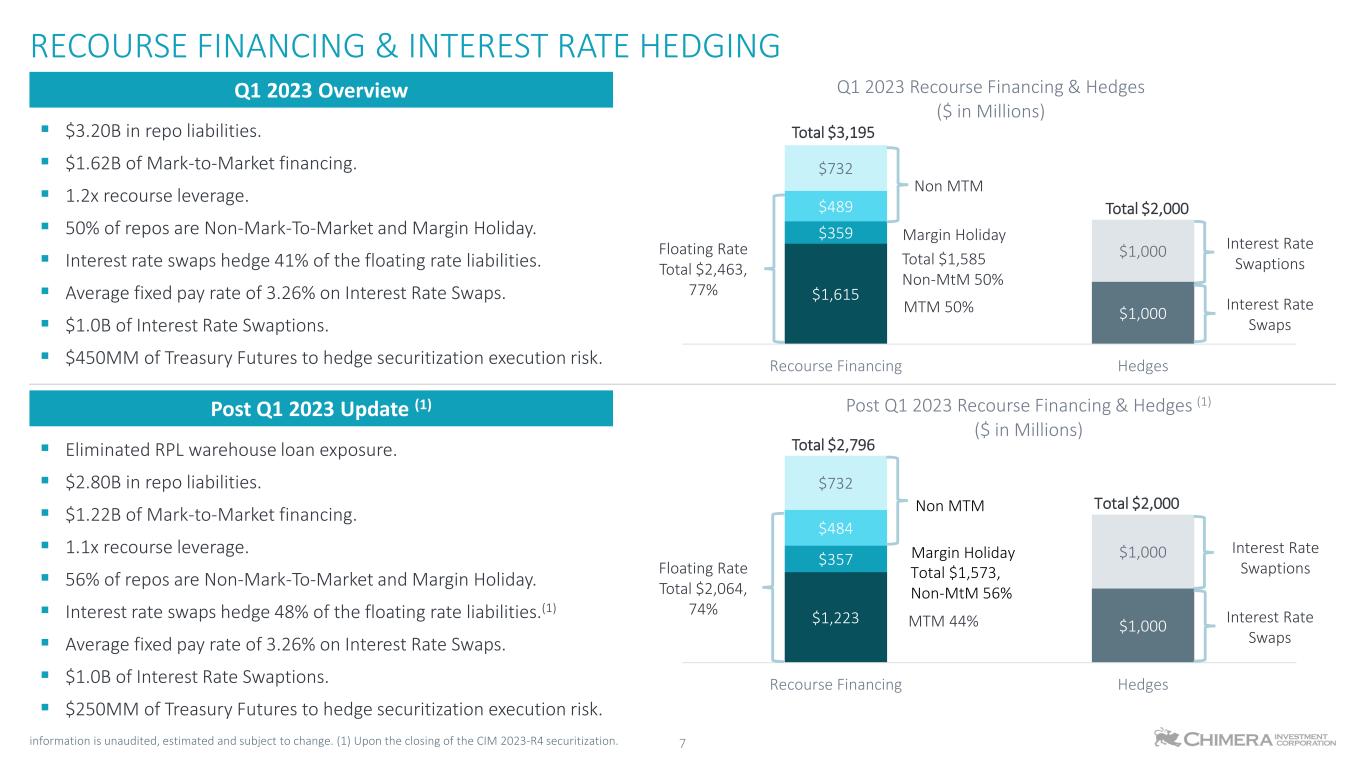

$3.20B in repo liabilities. $1.62B of Mark-to-Market financing. 1.2x recourse leverage. 50% of repos are Non-Mark-To-Market and Margin Holiday. Interest rate swaps hedge 41% of the floating rate liabilities. Average fixed pay rate of 3.26% on Interest Rate Swaps. $1.0B of Interest Rate Swaptions. $450MM of Treasury Futures to hedge securitization execution risk. Eliminated RPL warehouse loan exposure. $2.80B in repo liabilities. $1.22B of Mark-to-Market financing. 1.1x recourse leverage. 56% of repos are Non-Mark-To-Market and Margin Holiday. Interest rate swaps hedge 48% of the floating rate liabilities.(1) Average fixed pay rate of 3.26% on Interest Rate Swaps. $1.0B of Interest Rate Swaptions. $250MM of Treasury Futures to hedge securitization execution risk. RECOURSE FINANCING & INTEREST RATE HEDGING information is unaudited, estimated and subject to change. (1) Upon the closing of the CIM 2023-R4 securitization. Q1 2023 Overview Post Q1 2023 Update (1) 7 $1,615 $359 $489 $732 $1,000 $1,000 Recourse Financing Hedges Q1 2023 Recourse Financing & Hedges ($ in Millions) Total $2,000 Margin Holiday Total $1,585 Non-MtM 50% Non MTM Total $3,195 Floating Rate Total $2,463, 77% MTM 50% Interest Rate Swaptions Interest Rate Swaps $1,223 $357 $484 $732 $1,000 $1,000 Recourse Financing Hedges Post Q1 2023 Recourse Financing & Hedges (1) ($ in Millions) Margin Holiday Non MTM Total $1,573, Non-MtM 56% MTM 44% Total $2,796 Total $2,000 Floating Rate Total $2,064, 74% Interest Rate Swaptions Interest Rate Swaps

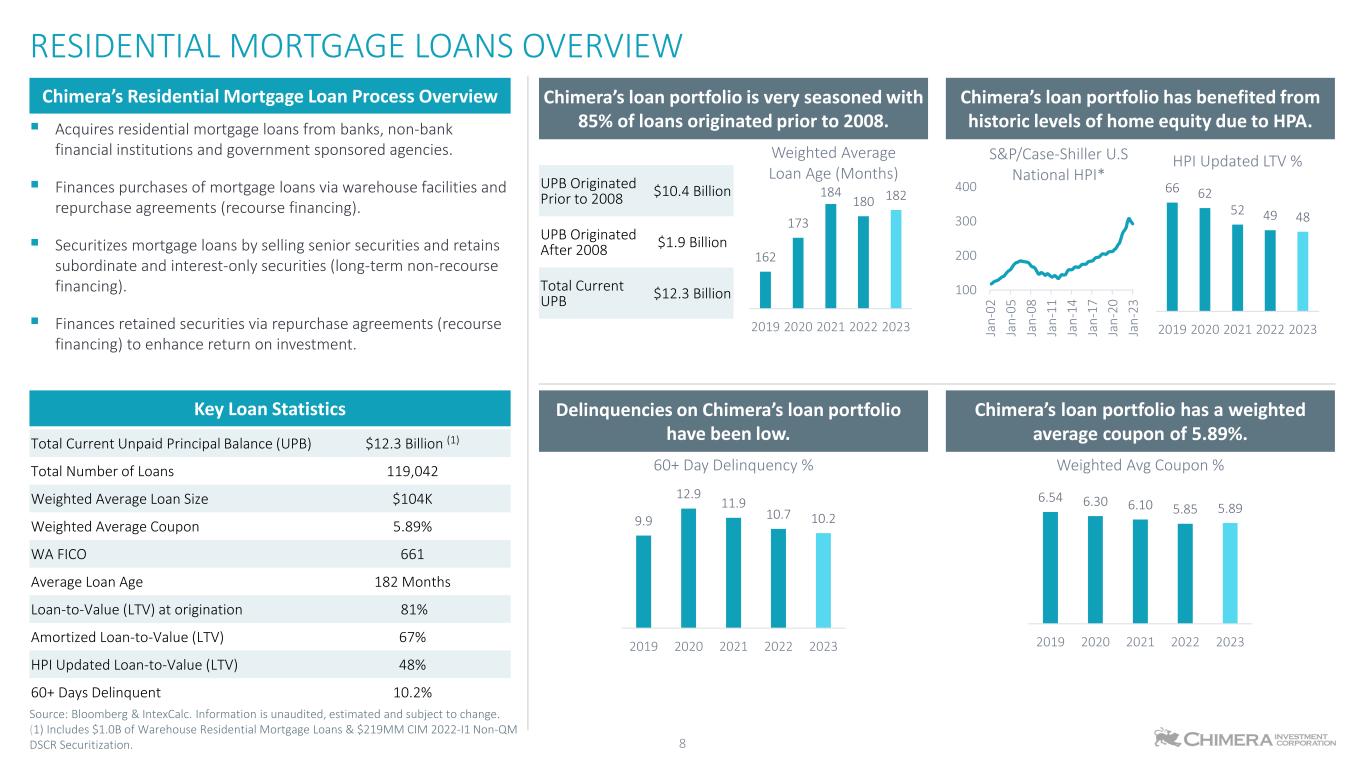

Chimera’s loan portfolio is very seasoned with 85% of loans originated prior to 2008. Acquires residential mortgage loans from banks, non-bank financial institutions and government sponsored agencies. Finances purchases of mortgage loans via warehouse facilities and repurchase agreements (recourse financing). Securitizes mortgage loans by selling senior securities and retains subordinate and interest-only securities (long-term non-recourse financing). Finances retained securities via repurchase agreements (recourse financing) to enhance return on investment. Chimera’s Residential Mortgage Loan Process Overview Key Loan Statistics Total Current Unpaid Principal Balance (UPB) $12.3 Billion (1) Total Number of Loans 119,042 Weighted Average Loan Size $104K Weighted Average Coupon 5.89% WA FICO 661 Average Loan Age 182 Months Loan-to-Value (LTV) at origination 81% Amortized Loan-to-Value (LTV) 67% HPI Updated Loan-to-Value (LTV) 48% 60+ Days Delinquent 10.2% RESIDENTIAL MORTGAGE LOANS OVERVIEW UPB Originated Prior to 2008 $10.4 Billion UPB Originated After 2008 $1.9 Billion Total Current UPB $12.3 Billion Chimera’s loan portfolio has benefited from historic levels of home equity due to HPA. 8 Source: Bloomberg & IntexCalc. Information is unaudited, estimated and subject to change. (1) Includes $1.0B of Warehouse Residential Mortgage Loans & $219MM CIM 2022-I1 Non-QM DSCR Securitization. Chimera’s loan portfolio has a weighted average coupon of 5.89%. Delinquencies on Chimera’s loan portfolio have been low. 100 200 300 400 Ja n- 02 Ja n- 05 Ja n- 08 Ja n- 11 Ja n- 14 Ja n- 17 Ja n- 20 Ja n- 23 S&P/Case-Shiller U.S National HPI* 162 173 184 180 182 2019 2020 2021 2022 2023 Weighted Average Loan Age (Months) 66 62 52 49 48 2019 2020 2021 2022 2023 HPI Updated LTV % 9.9 12.9 11.9 10.7 10.2 2019 2020 2021 2022 2023 60+ Day Delinquency % 6.54 6.30 6.10 5.85 5.89 2019 2020 2021 2022 2023 Weighted Avg Coupon %

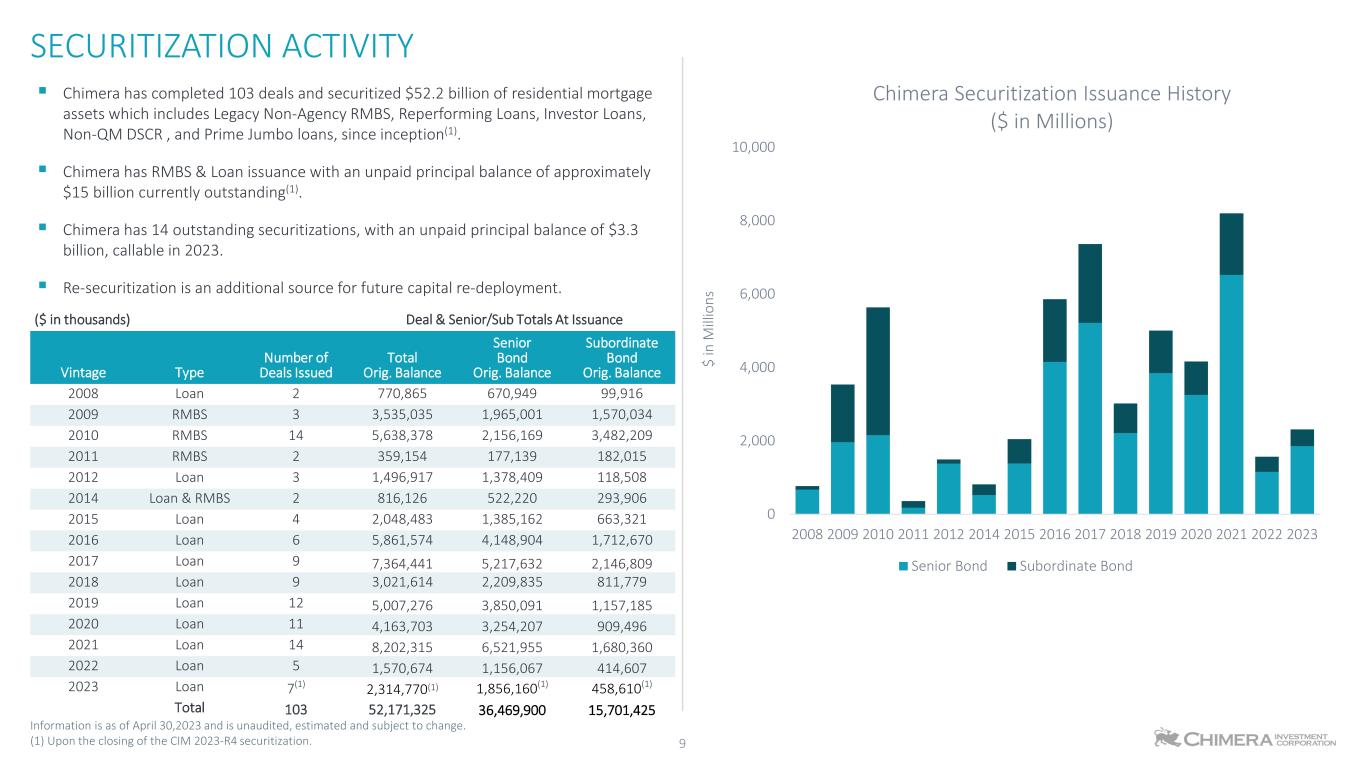

Chimera has completed 103 deals and securitized $52.2 billion of residential mortgage assets which includes Legacy Non-Agency RMBS, Reperforming Loans, Investor Loans, Non-QM DSCR , and Prime Jumbo loans, since inception(1). Chimera has RMBS & Loan issuance with an unpaid principal balance of approximately $15 billion currently outstanding(1). Chimera has 14 outstanding securitizations, with an unpaid principal balance of $3.3 billion, callable in 2023. Re-securitization is an additional source for future capital re-deployment. Type ($ in thousands) Deal & Senior/Sub Totals At Issuance Vintage Type Number of Deals Issued Total Orig. Balance Senior Bond Orig. Balance Subordinate Bond Orig. Balance 2008 Loan 2 770,865 670,949 99,916 2009 RMBS 3 3,535,035 1,965,001 1,570,034 2010 RMBS 14 5,638,378 2,156,169 3,482,209 2011 RMBS 2 359,154 177,139 182,015 2012 Loan 3 1,496,917 1,378,409 118,508 2014 Loan & RMBS 2 816,126 522,220 293,906 2015 Loan 4 2,048,483 1,385,162 663,321 2016 Loan 6 5,861,574 4,148,904 1,712,670 2017 Loan 9 7,364,441 5,217,632 2,146,809 2018 Loan 9 3,021,614 2,209,835 811,779 2019 Loan 12 5,007,276 3,850,091 1,157,185 2020 Loan 11 4,163,703 3,254,207 909,496 2021 Loan 14 8,202,315 6,521,955 1,680,360 2022 Loan 5 1,570,674 1,156,067 414,607 2023 Loan 7(1) 2,314,770(1) 1,856,160(1) 458,610(1) Total 103 52,171,325 36,469,900 15,701,425 SECURITIZATION ACTIVITY 9 Information is as of April 30,2023 and is unaudited, estimated and subject to change. (1) Upon the closing of the CIM 2023-R4 securitization. 0 2,000 4,000 6,000 8,000 10,000 2008 2009 2010 2011 2012 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 $ in M ill io ns Chimera Securitization Issuance History ($ in Millions) Senior Bond Subordinate Bond

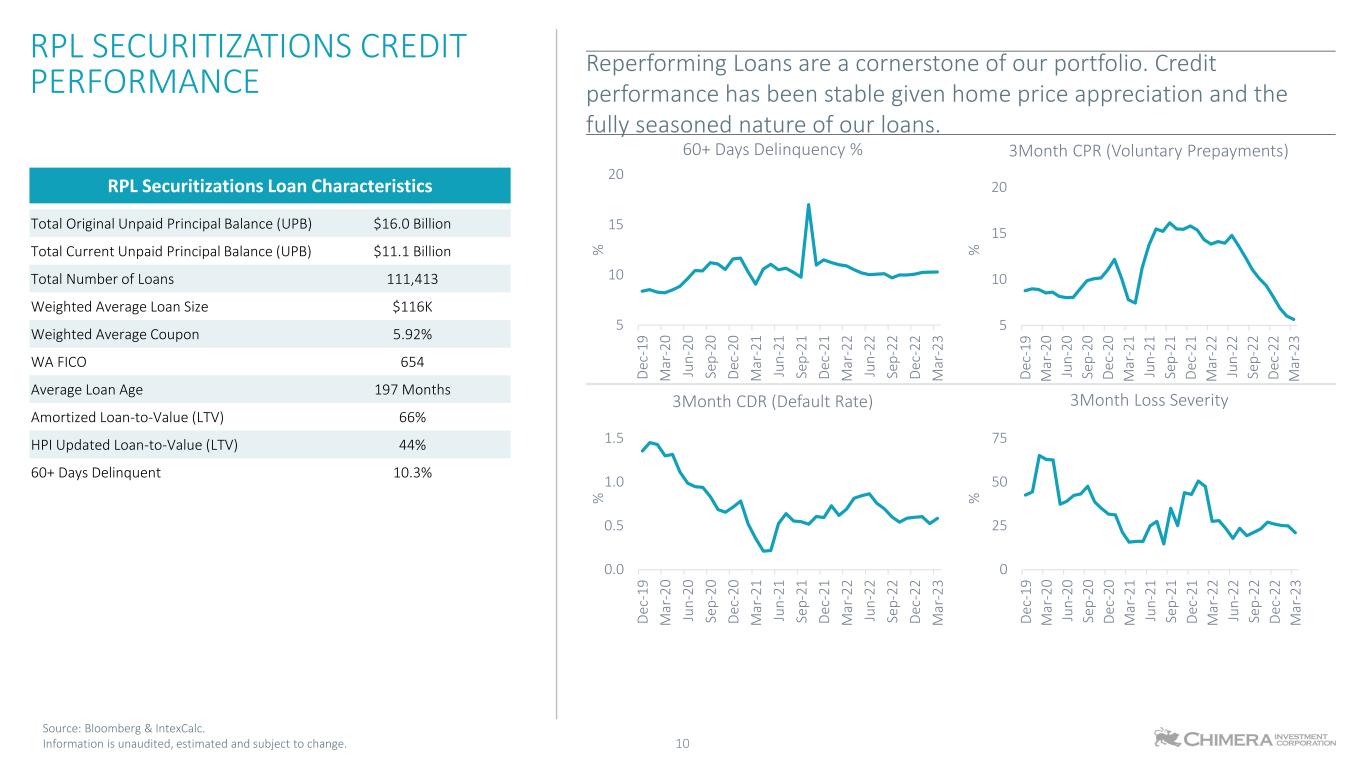

Reperforming Loans are a cornerstone of our portfolio. Credit performance has been stable given home price appreciation and the fully seasoned nature of our loans. RPL SECURITIZATIONS CREDIT PERFORMANCE 10 RPL Securitizations Loan Characteristics Total Original Unpaid Principal Balance (UPB) $16.0 Billion Total Current Unpaid Principal Balance (UPB) $11.1 Billion Total Number of Loans 111,413 Weighted Average Loan Size $116K Weighted Average Coupon 5.92% WA FICO 654 Average Loan Age 197 Months Amortized Loan-to-Value (LTV) 66% HPI Updated Loan-to-Value (LTV) 44% 60+ Days Delinquent 10.3% Source: Bloomberg & IntexCalc. Information is unaudited, estimated and subject to change. 5 10 15 20 De c- 19 M ar -2 0 Ju n- 20 Se p- 20 De c- 20 M ar -2 1 Ju n- 21 Se p- 21 De c- 21 M ar -2 2 Ju n- 22 Se p- 22 De c- 22 M ar -2 3 % 60+ Days Delinquency % 5 10 15 20 De c- 19 M ar -2 0 Ju n- 20 Se p- 20 De c- 20 M ar -2 1 Ju n- 21 Se p- 21 De c- 21 M ar -2 2 Ju n- 22 Se p- 22 De c- 22 M ar -2 3 % 3Month CPR (Voluntary Prepayments) 0.0 0.5 1.0 1.5 De c- 19 M ar -2 0 Ju n- 20 Se p- 20 De c- 20 M ar -2 1 Ju n- 21 Se p- 21 De c- 21 M ar -2 2 Ju n- 22 Se p- 22 De c- 22 M ar -2 3 % 3Month CDR (Default Rate) 0 25 50 75 De c- 19 M ar -2 0 Ju n- 20 Se p- 20 De c- 20 M ar -2 1 Ju n- 21 Se p- 21 De c- 21 M ar -2 2 Ju n- 22 Se p- 22 De c- 22 M ar -2 3 % 3Month Loss Severity

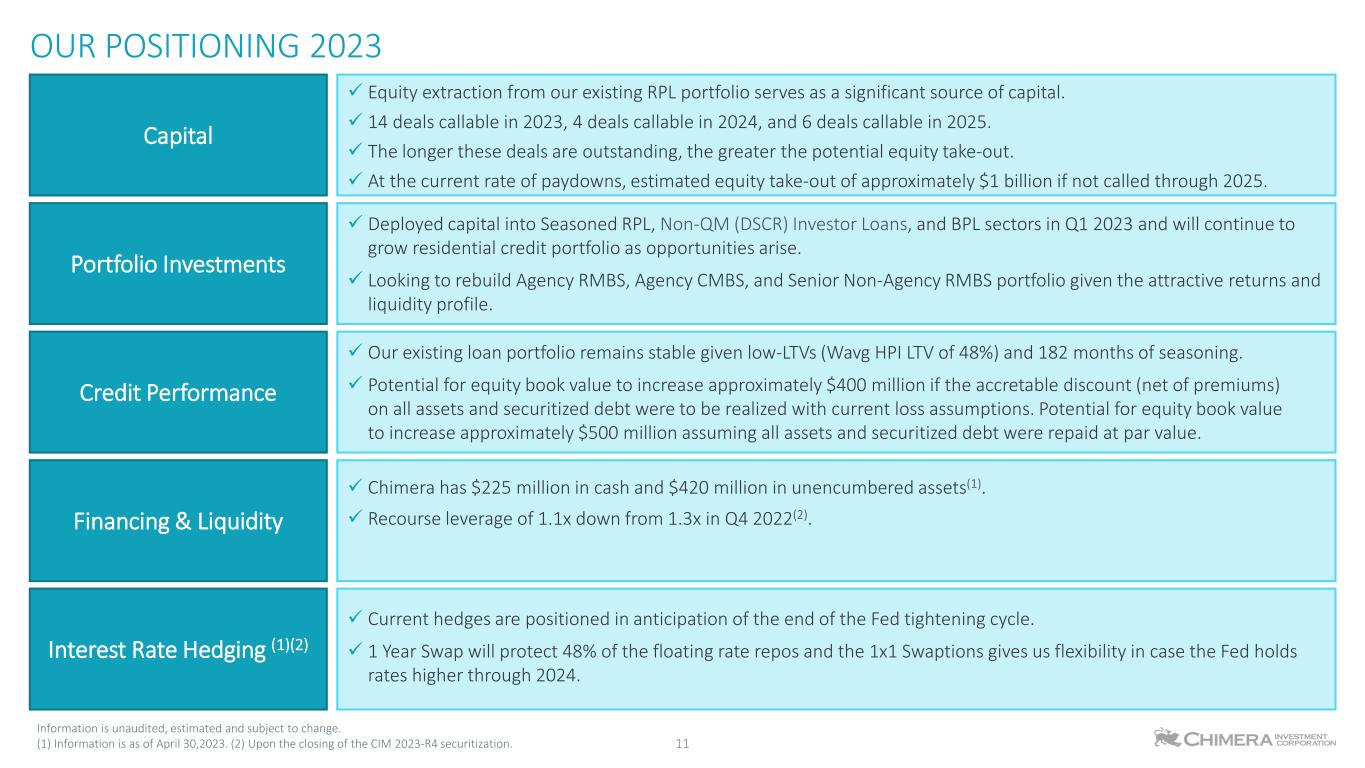

OUR POSITIONING 2023 11 Information is unaudited, estimated and subject to change. (1) Information is as of April 30,2023. (2) Upon the closing of the CIM 2023-R4 securitization. Portfolio Investments Equity extraction from our existing RPL portfolio serves as a significant source of capital. 14 deals callable in 2023, 4 deals callable in 2024, and 6 deals callable in 2025. The longer these deals are outstanding, the greater the potential equity take-out. At the current rate of paydowns, estimated equity take-out of approximately $1 billion if not called through 2025. Capital Deployed capital into Seasoned RPL, Non-QM (DSCR) Investor Loans, and BPL sectors in Q1 2023 and will continue to grow residential credit portfolio as opportunities arise. Looking to rebuild Agency RMBS, Agency CMBS, and Senior Non-Agency RMBS portfolio given the attractive returns and liquidity profile. Credit Performance Our existing loan portfolio remains stable given low-LTVs (Wavg HPI LTV of 48%) and 182 months of seasoning. Potential for equity book value to increase approximately $400 million if the accretable discount (net of premiums) on all assets and securitized debt were to be realized with current loss assumptions. Potential for equity book value to increase approximately $500 million assuming all assets and securitized debt were repaid at par value. Financing & Liquidity Chimera has $225 million in cash and $420 million in unencumbered assets(1). Recourse leverage of 1.1x down from 1.3x in Q4 2022(2). Interest Rate Hedging (1)(2) Current hedges are positioned in anticipation of the end of the Fed tightening cycle. 1 Year Swap will protect 48% of the floating rate repos and the 1x1 Swaptions gives us flexibility in case the Fed holds rates higher through 2024.

APPENDIX

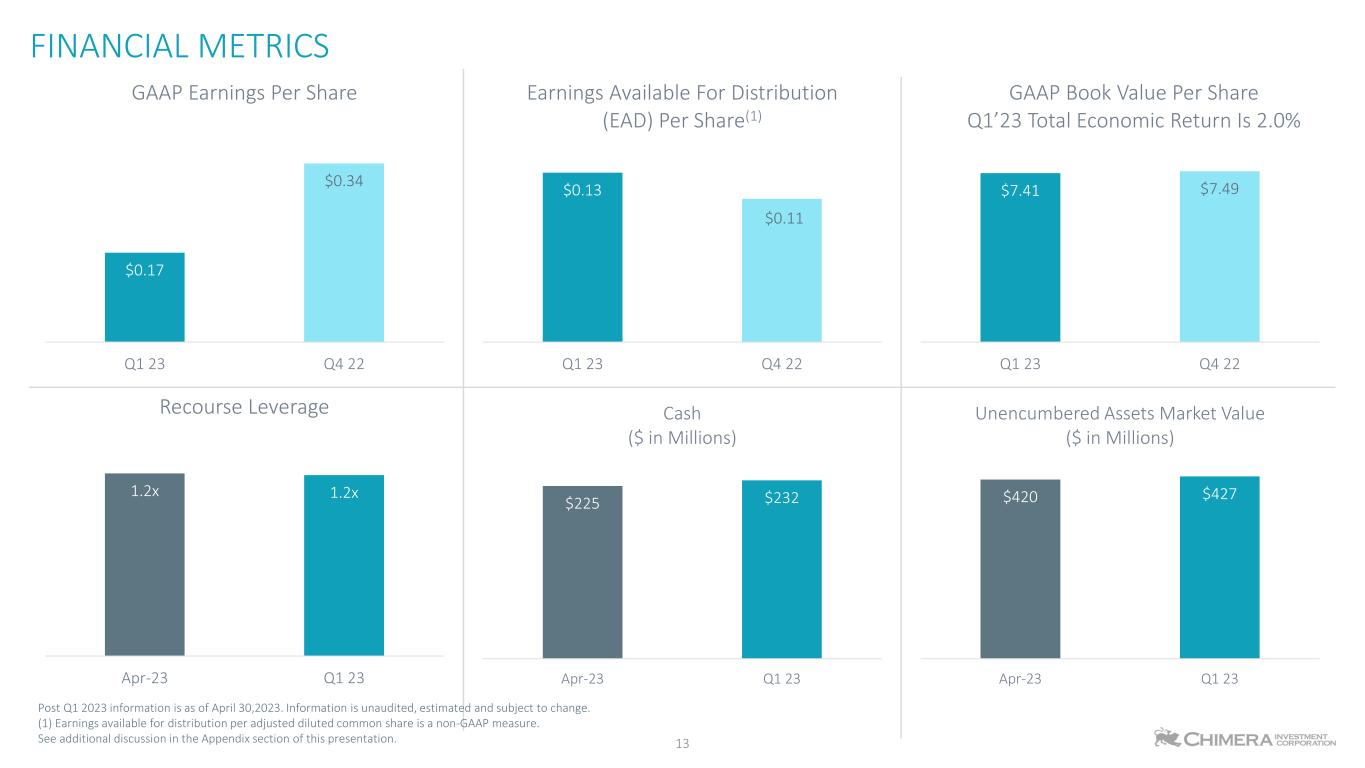

13 FINANCIAL METRICS Post Q1 2023 information is as of April 30,2023. Information is unaudited, estimated and subject to change. (1) Earnings available for distribution per adjusted diluted common share is a non-GAAP measure. See additional discussion in the Appendix section of this presentation. $0.17 $0.34 Q1 23 Q4 22 GAAP Earnings Per Share $0.13 $0.11 Q1 23 Q4 22 Earnings Available For Distribution (EAD) Per Share(1) $7.41 $7.49 Q1 23 Q4 22 GAAP Book Value Per Share Q1’23 Total Economic Return Is 2.0% 1.2x 1.2x Apr-23 Q1 23 Recourse Leverage $225 $232 Apr-23 Q1 23 Cash ($ in Millions) $420 $427 Apr-23 Q1 23 Unencumbered Assets Market Value ($ in Millions)

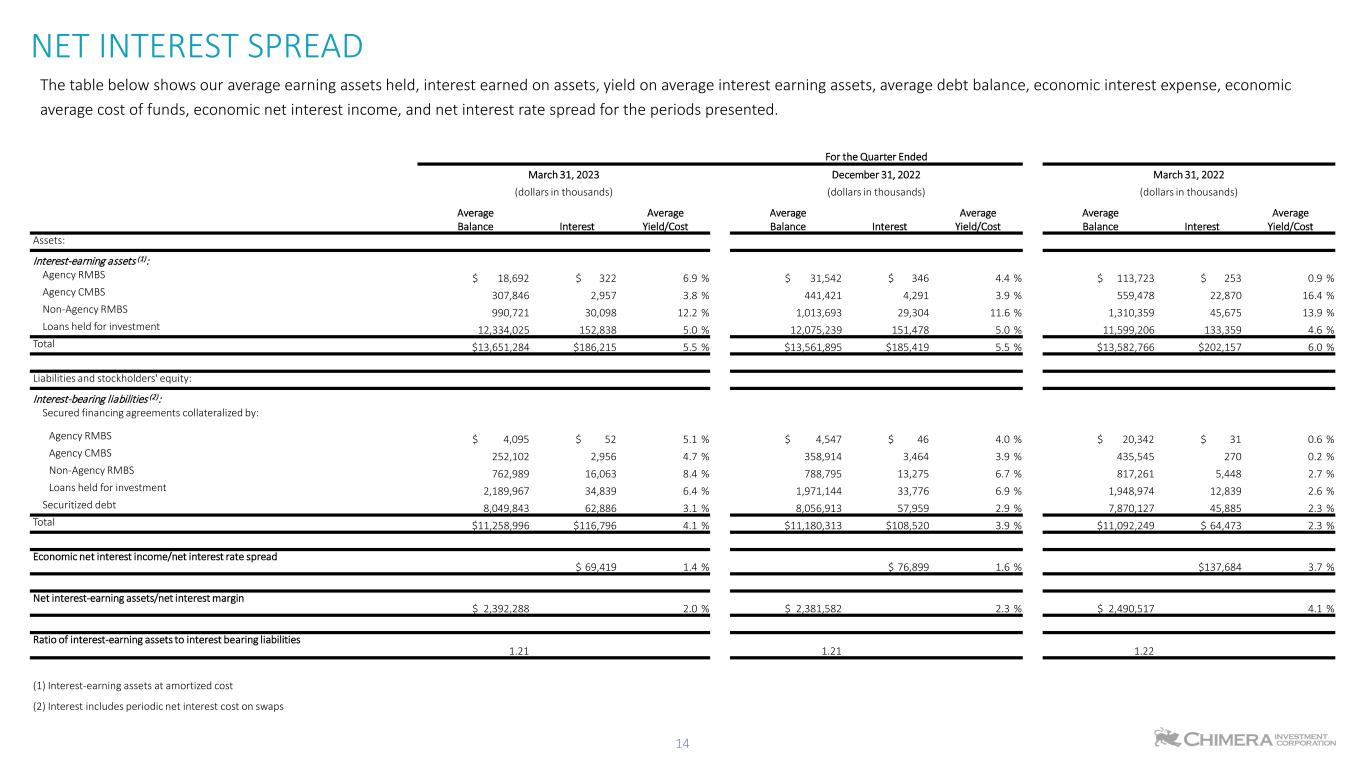

NET INTEREST SPREAD 14 The table below shows our average earning assets held, interest earned on assets, yield on average interest earning assets, average debt balance, economic interest expense, economic average cost of funds, economic net interest income, and net interest rate spread for the periods presented. For the Quarter Ended March 31, 2023 December 31, 2022 March 31, 2022 (dollars in thousands) (dollars in thousands) (dollars in thousands) Average Balance Interest Average Yield/Cost Average Balance Interest Average Yield/Cost Average Balance Interest Average Yield/Cost Assets: Interest-earning assets (1): Agency RMBS $ 18,692 $ 322 6.9 % $ 31,542 $ 346 4.4 % $ 113,723 $ 253 0.9 % Agency CMBS 307,846 2,957 3.8 % 441,421 4,291 3.9 % 559,478 22,870 16.4 % Non-Agency RMBS 990,721 30,098 12.2 % 1,013,693 29,304 11.6 % 1,310,359 45,675 13.9 % Loans held for investment 12,334,025 152,838 5.0 % 12,075,239 151,478 5.0 % 11,599,206 133,359 4.6 % Total $13,651,284 $186,215 5.5 % $13,561,895 $185,419 5.5 % $13,582,766 $202,157 6.0 % Liabilities and stockholders' equity: Interest-bearing liabilities (2): Secured financing agreements collateralized by: Agency RMBS $ 4,095 $ 52 5.1 % $ 4,547 $ 46 4.0 % $ 20,342 $ 31 0.6 % Agency CMBS 252,102 2,956 4.7 % 358,914 3,464 3.9 % 435,545 270 0.2 % Non-Agency RMBS 762,989 16,063 8.4 % 788,795 13,275 6.7 % 817,261 5,448 2.7 % Loans held for investment 2,189,967 34,839 6.4 % 1,971,144 33,776 6.9 % 1,948,974 12,839 2.6 % Securitized debt 8,049,843 62,886 3.1 % 8,056,913 57,959 2.9 % 7,870,127 45,885 2.3 % Total $11,258,996 $116,796 4.1 % $11,180,313 $108,520 3.9 % $11,092,249 $ 64,473 2.3 % Economic net interest income/net interest rate spread $ 69,419 1.4 % $ 76,899 1.6 % $137,684 3.7 % Net interest-earning assets/net interest margin $ 2,392,288 2.0 % $ 2,381,582 2.3 % $ 2,490,517 4.1 % Ratio of interest-earning assets to interest bearing liabilities 1.21 1.21 1.22 (1) Interest-earning assets at amortized cost (2) Interest includes periodic net interest cost on swaps

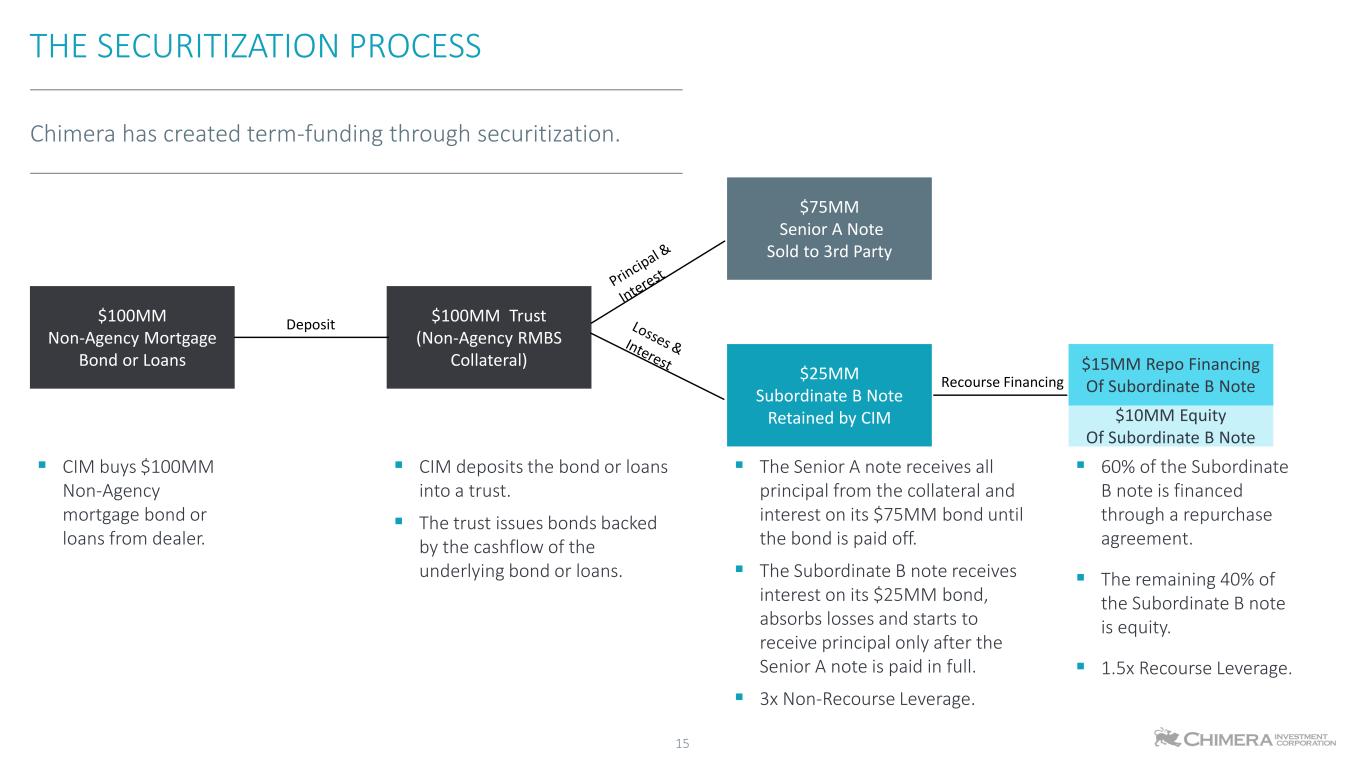

Chimera has created term-funding through securitization. THE SECURITIZATION PROCESS CIM buys $100MM Non-Agency mortgage bond or loans from dealer. CIM deposits the bond or loans into a trust. The trust issues bonds backed by the cashflow of the underlying bond or loans. The Senior A note receives all principal from the collateral and interest on its $75MM bond until the bond is paid off. The Subordinate B note receives interest on its $25MM bond, absorbs losses and starts to receive principal only after the Senior A note is paid in full. 3x Non-Recourse Leverage. $100MM Non-Agency Mortgage Bond or Loans $100MM Trust (Non-Agency RMBS Collateral) $75MM Senior A Note Sold to 3rd Party $25MM Subordinate B Note Retained by CIM Deposit 15 Recourse Financing $15MM Repo Financing Of Subordinate B Note $10MM Equity Of Subordinate B Note 60% of the Subordinate B note is financed through a repurchase agreement. The remaining 40% of the Subordinate B note is equity. 1.5x Recourse Leverage.

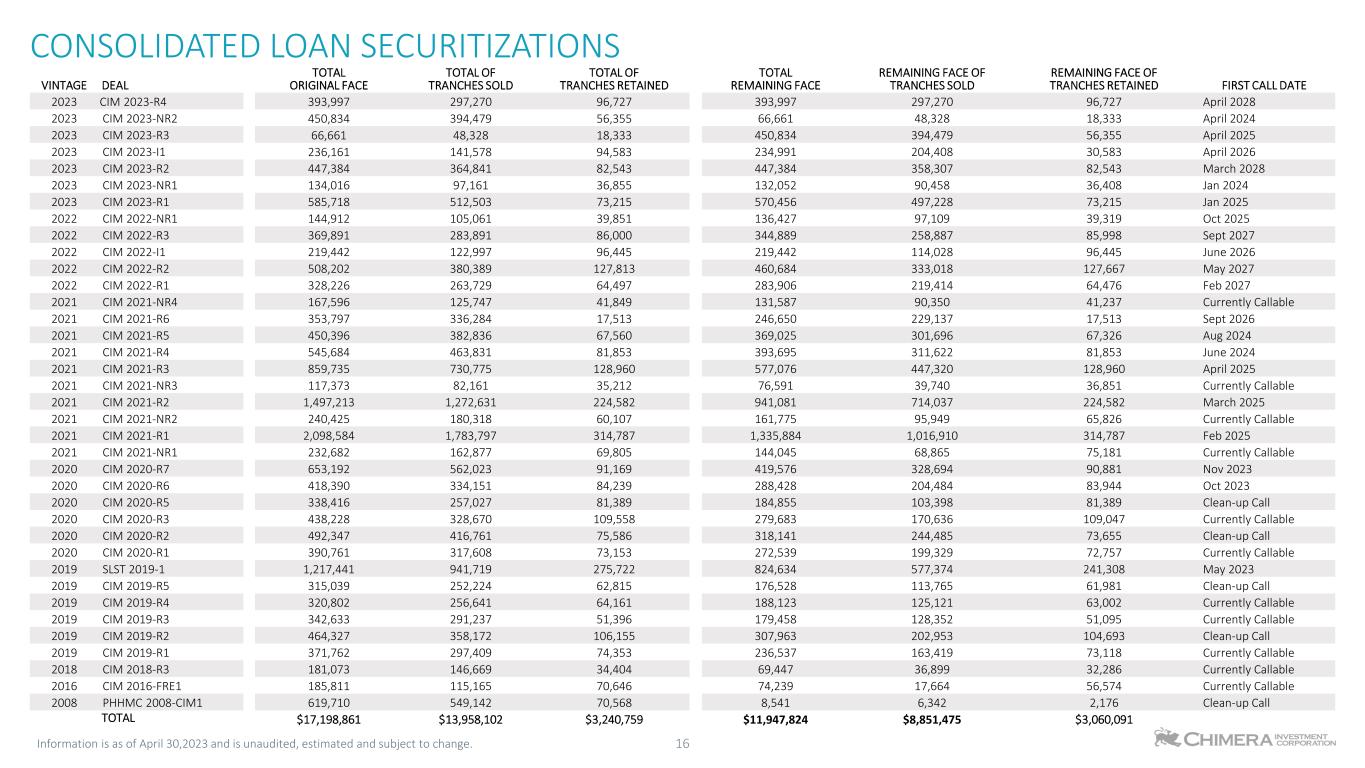

CONSOLIDATED LOAN SECURITIZATIONS 16 VINTAGE DEAL TOTAL ORIGINAL FACE TOTAL OF TRANCHES SOLD TOTAL OF TRANCHES RETAINED TOTAL REMAINING FACE REMAINING FACE OF TRANCHES SOLD REMAINING FACE OF TRANCHES RETAINED FIRST CALL DATE 2023 CIM 2023-R4 393,997 297,270 96,727 393,997 297,270 96,727 April 2028 2023 CIM 2023-NR2 450,834 394,479 56,355 66,661 48,328 18,333 April 2024 2023 CIM 2023-R3 66,661 48,328 18,333 450,834 394,479 56,355 April 2025 2023 CIM 2023-I1 236,161 141,578 94,583 234,991 204,408 30,583 April 2026 2023 CIM 2023-R2 447,384 364,841 82,543 447,384 358,307 82,543 March 2028 2023 CIM 2023-NR1 134,016 97,161 36,855 132,052 90,458 36,408 Jan 2024 2023 CIM 2023-R1 585,718 512,503 73,215 570,456 497,228 73,215 Jan 2025 2022 CIM 2022-NR1 144,912 105,061 39,851 136,427 97,109 39,319 Oct 2025 2022 CIM 2022-R3 369,891 283,891 86,000 344,889 258,887 85,998 Sept 2027 2022 CIM 2022-I1 219,442 122,997 96,445 219,442 114,028 96,445 June 2026 2022 CIM 2022-R2 508,202 380,389 127,813 460,684 333,018 127,667 May 2027 2022 CIM 2022-R1 328,226 263,729 64,497 283,906 219,414 64,476 Feb 2027 2021 CIM 2021-NR4 167,596 125,747 41,849 131,587 90,350 41,237 Currently Callable 2021 CIM 2021-R6 353,797 336,284 17,513 246,650 229,137 17,513 Sept 2026 2021 CIM 2021-R5 450,396 382,836 67,560 369,025 301,696 67,326 Aug 2024 2021 CIM 2021-R4 545,684 463,831 81,853 393,695 311,622 81,853 June 2024 2021 CIM 2021-R3 859,735 730,775 128,960 577,076 447,320 128,960 April 2025 2021 CIM 2021-NR3 117,373 82,161 35,212 76,591 39,740 36,851 Currently Callable 2021 CIM 2021-R2 1,497,213 1,272,631 224,582 941,081 714,037 224,582 March 2025 2021 CIM 2021-NR2 240,425 180,318 60,107 161,775 95,949 65,826 Currently Callable 2021 CIM 2021-R1 2,098,584 1,783,797 314,787 1,335,884 1,016,910 314,787 Feb 2025 2021 CIM 2021-NR1 232,682 162,877 69,805 144,045 68,865 75,181 Currently Callable 2020 CIM 2020-R7 653,192 562,023 91,169 419,576 328,694 90,881 Nov 2023 2020 CIM 2020-R6 418,390 334,151 84,239 288,428 204,484 83,944 Oct 2023 2020 CIM 2020-R5 338,416 257,027 81,389 184,855 103,398 81,389 Clean-up Call 2020 CIM 2020-R3 438,228 328,670 109,558 279,683 170,636 109,047 Currently Callable 2020 CIM 2020-R2 492,347 416,761 75,586 318,141 244,485 73,655 Clean-up Call 2020 CIM 2020-R1 390,761 317,608 73,153 272,539 199,329 72,757 Currently Callable 2019 SLST 2019-1 1,217,441 941,719 275,722 824,634 577,374 241,308 May 2023 2019 CIM 2019-R5 315,039 252,224 62,815 176,528 113,765 61,981 Clean-up Call 2019 CIM 2019-R4 320,802 256,641 64,161 188,123 125,121 63,002 Currently Callable 2019 CIM 2019-R3 342,633 291,237 51,396 179,458 128,352 51,095 Currently Callable 2019 CIM 2019-R2 464,327 358,172 106,155 307,963 202,953 104,693 Clean-up Call 2019 CIM 2019-R1 371,762 297,409 74,353 236,537 163,419 73,118 Currently Callable 2018 CIM 2018-R3 181,073 146,669 34,404 69,447 36,899 32,286 Currently Callable 2016 CIM 2016-FRE1 185,811 115,165 70,646 74,239 17,664 56,574 Currently Callable 2008 PHHMC 2008-CIM1 619,710 549,142 70,568 8,541 6,342 2,176 Clean-up Call TOTAL $17,198,861 $13,958,102 $3,240,759 $11,947,824 $8,851,475 $3,060,091 Information is as of April 30,2023 and is unaudited, estimated and subject to change.

EARNINGS AVAILABLE FOR DISTRIBUTION Earnings available for distribution is a non-GAAP measure and is defined as GAAP net income excluding unrealized gains or losses on financial instruments carried at fair value with changes in fair value recorded in earnings, realized gains or losses on the sales of investments, gains or losses on the extinguishment of debt, interest expense on long term debt, changes in the provision for credit losses, other gains or losses on equity investments, and transaction expenses incurred. In addition, stock compensation expense charges incurred on awards to retirement eligible employees is reflected as an expense over a vesting period (36 months) rather than reported as an immediate expense. Earnings available for distribution is the Economic net interest income, reduced by compensation and benefits expenses (adjusted for awards to retirement eligible employees), general and administrative expenses, servicing and asset manager fees, income tax benefits or expenses incurred during the period, as well as the preferred dividend charges. Economic net interest income is a non-GAAP financial measure that equals GAAP net interest income adjusted for interest expense on long term debt, net periodic interest cost of interest rate swaps and excludes interest earned on cash. See a reconciliation of Economic net interest income to the most relevant GAAP measure below. We view Earnings available for distribution as one measure of our investment portfolio's ability to generate income for distribution to common stockholders. Earnings available for distribution is one of the metrics, but not the exclusive metric, that our Board of Directors uses to determine the amount, if any, of dividends on our common stock. Other metrics that our Board of Directors may consider when determining the amount, if any, of dividends on our common stock include (among others) REIT taxable income, dividend yield, book value, cash generated from the portfolio, reinvestment opportunities and other cash needs. In addition, Earnings available for distribution is different than REIT taxable income and the determination of whether we have met the requirement to distribute at least 90% of our annual REIT taxable income (subject to certain adjustments) to our stockholders in order to maintain qualification as a REIT is not based on Earnings available for distribution. Therefore, Earnings available for distribution should not be considered as an indication of our REIT taxable income, a guaranty of our ability to pay dividends, or as a proxy for the amount of dividends we may pay. We believe Earnings available for distribution as described above helps us and investors evaluate our financial performance period over period without the impact of certain transactions. Therefore, Earnings available for distribution should not be viewed in isolation and is not a substitute for net income or net income per basic share computed in accordance with GAAP. In addition, our methodology for calculating Earnings available for distribution may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and accordingly, our Earnings available for distribution may not be comparable to the Earnings available for distribution reported by other REITs. 17

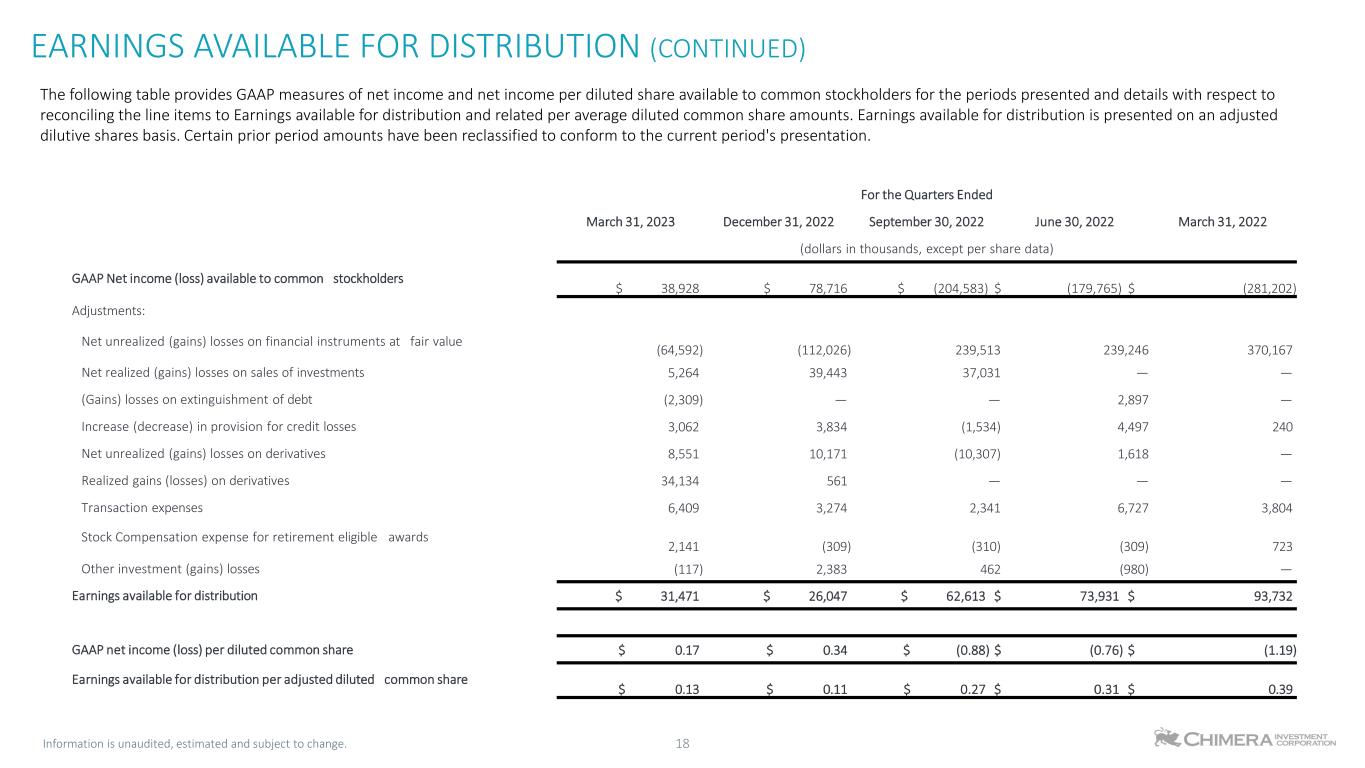

EARNINGS AVAILABLE FOR DISTRIBUTION (CONTINUED) 18 The following table provides GAAP measures of net income and net income per diluted share available to common stockholders for the periods presented and details with respect to reconciling the line items to Earnings available for distribution and related per average diluted common share amounts. Earnings available for distribution is presented on an adjusted dilutive shares basis. Certain prior period amounts have been reclassified to conform to the current period's presentation. For the Quarters Ended March 31, 2023 December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 (dollars in thousands, except per share data) GAAP Net income (loss) available to common stockholders $ 38,928 $ 78,716 $ (204,583) $ (179,765) $ (281,202) Adjustments: Net unrealized (gains) losses on financial instruments at fair value (64,592) (112,026) 239,513 239,246 370,167 Net realized (gains) losses on sales of investments 5,264 39,443 37,031 — — (Gains) losses on extinguishment of debt (2,309) — — 2,897 — Increase (decrease) in provision for credit losses 3,062 3,834 (1,534) 4,497 240 Net unrealized (gains) losses on derivatives 8,551 10,171 (10,307) 1,618 — Realized gains (losses) on derivatives 34,134 561 — — — Transaction expenses 6,409 3,274 2,341 6,727 3,804 Stock Compensation expense for retirement eligible awards 2,141 (309) (310) (309) 723 Other investment (gains) losses (117) 2,383 462 (980) — Earnings available for distribution $ 31,471 $ 26,047 $ 62,613 $ 73,931 $ 93,732 GAAP net income (loss) per diluted common share $ 0.17 $ 0.34 $ (0.88) $ (0.76) $ (1.19) Earnings available for distribution per adjusted diluted common share $ 0.13 $ 0.11 $ 0.27 $ 0.31 $ 0.39 Information is unaudited, estimated and subject to change.

Information is unaudited, estimated and subject to change. 19