EX-99.2

Published on November 2, 2023

INVESTOR PRESENTATION Q3 2023

DISCLAIMER 2 This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “goal” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our most recent Annual Report on Form 10-K, and any subsequent Quarterly Reports on Form 10-Q and Current Report on Form 8-K, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: our business and investment strategy; our ability to accurately forecast the payment of future dividends on our common and preferred stock, and the amount of such dividends; our ability to determine accurately the fair market value of our assets; availability of investment opportunities in real estate-related and other securities, including our valuation of potential opportunities that may arise as a result of current and future market dislocations; our expected investments; changes in the value of our investments, including negative changes resulting in margin calls related to the financing of our assets; changes in inflation, interest rates and mortgage prepayment rates; prepayments of the mortgage and other loans underlying our mortgage- backed securities, or MBS, or other asset-backed securities, or ABS; rates of default, delinquencies, forbearance, deferred payments, or decreased recovery rates on our investments; general volatility of the securities markets in which we invest; our ability to maintain existing financing arrangements and our ability to obtain future financing arrangements; our ability to effect our strategy to securitize residential mortgage loans; interest rate mismatches between our investments and our borrowings used to finance such purchases; effects of interest rate caps on our adjustable-rate investments; the degree to which our hedging strategies may or may not protect us from interest rate volatility; the impact of and changes to various government programs; the impact of and changes in governmental regulations, tax law and rates, accounting guidance, and similar matters; market trends in our industry, interest rates, the debt securities markets or the general economy; estimates relating to our ability to make distributions to our stockholders in the future; our understanding of our competition; qualified personnel; our ability to maintain our classification as a real estate investment trust, or, REIT, for U.S. federal income tax purposes; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended, or 1940 Act; our expectations regarding materiality or significance; and the effectiveness of our disclosure controls and procedures. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Chimera does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these, and other risk factors is contained in Chimera’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Chimera or matters attributable to Chimera or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. All information in this presentation is as of March 31, 2023, unless stated otherwise. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors.

CHIMERA IS A RESIDENTIAL CREDIT HYBRID MORTGAGE REIT 3 Established in 2007 Internally managed since August 2015 Total equity capital of approximately $2.5 billion, including approximately $1.6 billion common stock and $930 million preferred stock Chimera (CIM) has distributed $6.1 billion to common and preferred stockholders since inception Total leverage ratio 4.1:1 / Recourse leverage ratio 1.0:1 Residential Mortgage Loans represent a significant part of our business and growth strategy. Our Residential Mortgage Loan portfolio is comprised of Re-Performing Loans (RPLs), Non-QM & Investor Loans, Business Purpose Loans (BPLs), and Prime Jumbo Loans. Our Mission Is To Deliver Attractive, Risk-Adjusted Returns. Information is unaudited, estimated and subject to change.

2023 ACTIVITY OVERVIEW 4 Information is for the nine months ended September 30th ,2023 and is unaudited, estimated and subject to change. Continued focus on acquiring and securitizing residential mortgage loans. Purchased $1.3 billion of diversified residential mortgage loans. 56% were Seasoned RPLs, 37% were Non-QM (DSCR) Investor Loans, and the remainder were Business Purpose Loans (BPLs). Issued $841 million in Seasoned RPL securitizations and a Non-QM (DSCR) Investor Loans securitization totaling $475 million. Further implemented our call optimization strategy on CIM securitizations. We exercised the call rights and terminated six existing Seasoned RPL securitizations and issued 4 new Seasoned RPL securitizations totaling $1.2 billion. Resulted in re-capturing approximately $130 million. 2 securitizations have a 1-year call option, and 2 securitizations have a 2-year call option providing the ability to take advantage of future rate declines. Total securitizations of $2.6 billion. Repurchased $33 million of common shares at a weighted average price of $5.66 per share. Reduced our total recourse financing exposure by approximately $831 million. Eliminated RPL warehouse loan exposure. Decrease in recourse leverage from 1.3x as of Q4 2022 to 1.0x Our interest rate hedging allows us optionality to benefit from lower interest rates in the future. Interest rate swaps protect approximately 53% of our floating rate liabilities. $1.5 billion of interest rate swaptions provide flexibility in an environment where rates are higher for longer.

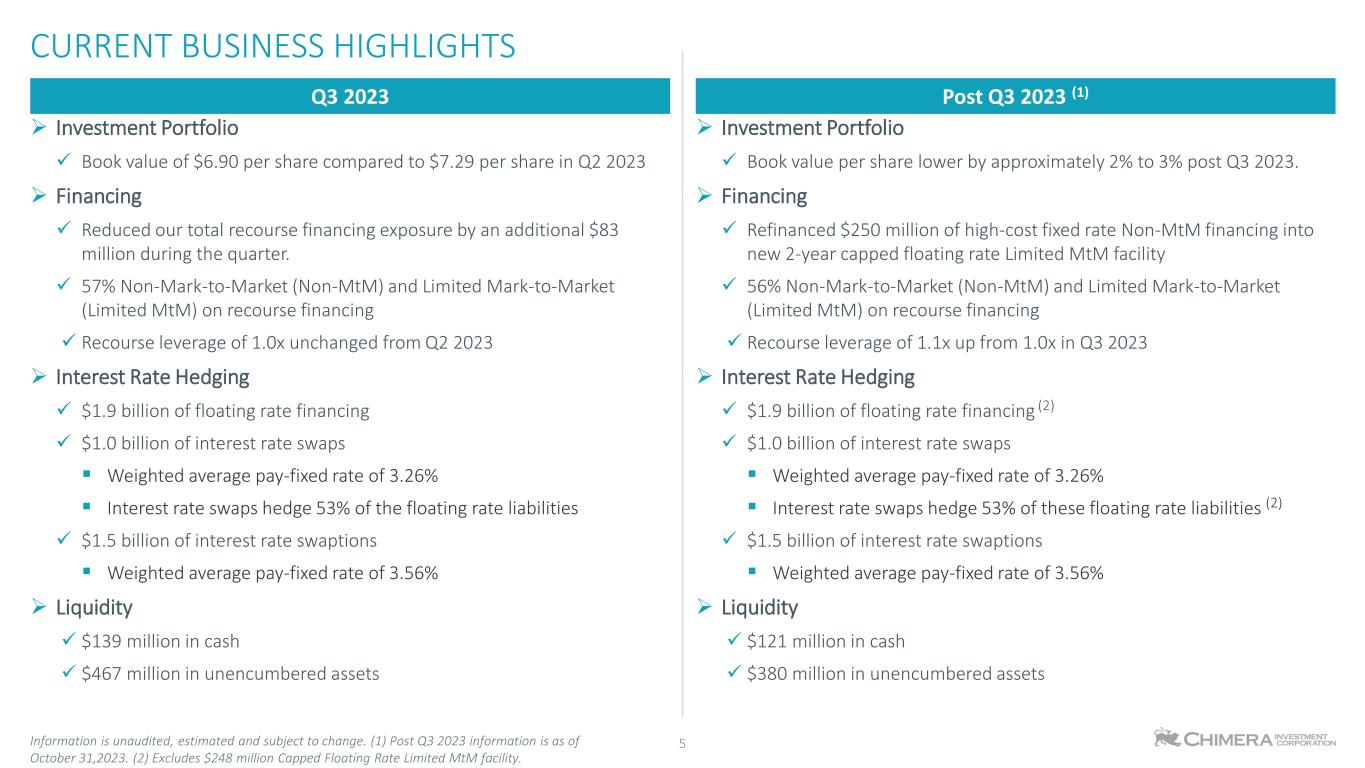

CURRENT BUSINESS HIGHLIGHTS 5 Investment Portfolio Book value of $6.90 per share compared to $7.29 per share in Q2 2023 Financing Reduced our total recourse financing exposure by an additional $83 million during the quarter. 57% Non-Mark-to-Market (Non-MtM) and Limited Mark-to-Market (Limited MtM) on recourse financing Recourse leverage of 1.0x unchanged from Q2 2023 Interest Rate Hedging $1.9 billion of floating rate financing $1.0 billion of interest rate swaps Weighted average pay-fixed rate of 3.26% Interest rate swaps hedge 53% of the floating rate liabilities $1.5 billion of interest rate swaptions Weighted average pay-fixed rate of 3.56% Liquidity $139 million in cash $467 million in unencumbered assets Q3 2023 Post Q3 2023 (1) Investment Portfolio Book value per share lower by approximately 2% to 3% post Q3 2023. Financing Refinanced $250 million of high-cost fixed rate Non-MtM financing into new 2-year capped floating rate Limited MtM facility 56% Non-Mark-to-Market (Non-MtM) and Limited Mark-to-Market (Limited MtM) on recourse financing Recourse leverage of 1.1x up from 1.0x in Q3 2023 Interest Rate Hedging $1.9 billion of floating rate financing (2) $1.0 billion of interest rate swaps Weighted average pay-fixed rate of 3.26% Interest rate swaps hedge 53% of these floating rate liabilities (2) $1.5 billion of interest rate swaptions Weighted average pay-fixed rate of 3.56% Liquidity $121 million in cash $380 million in unencumbered assets Information is unaudited, estimated and subject to change. (1) Post Q3 2023 information is as of October 31,2023. (2) Excludes $248 million Capped Floating Rate Limited MtM facility.

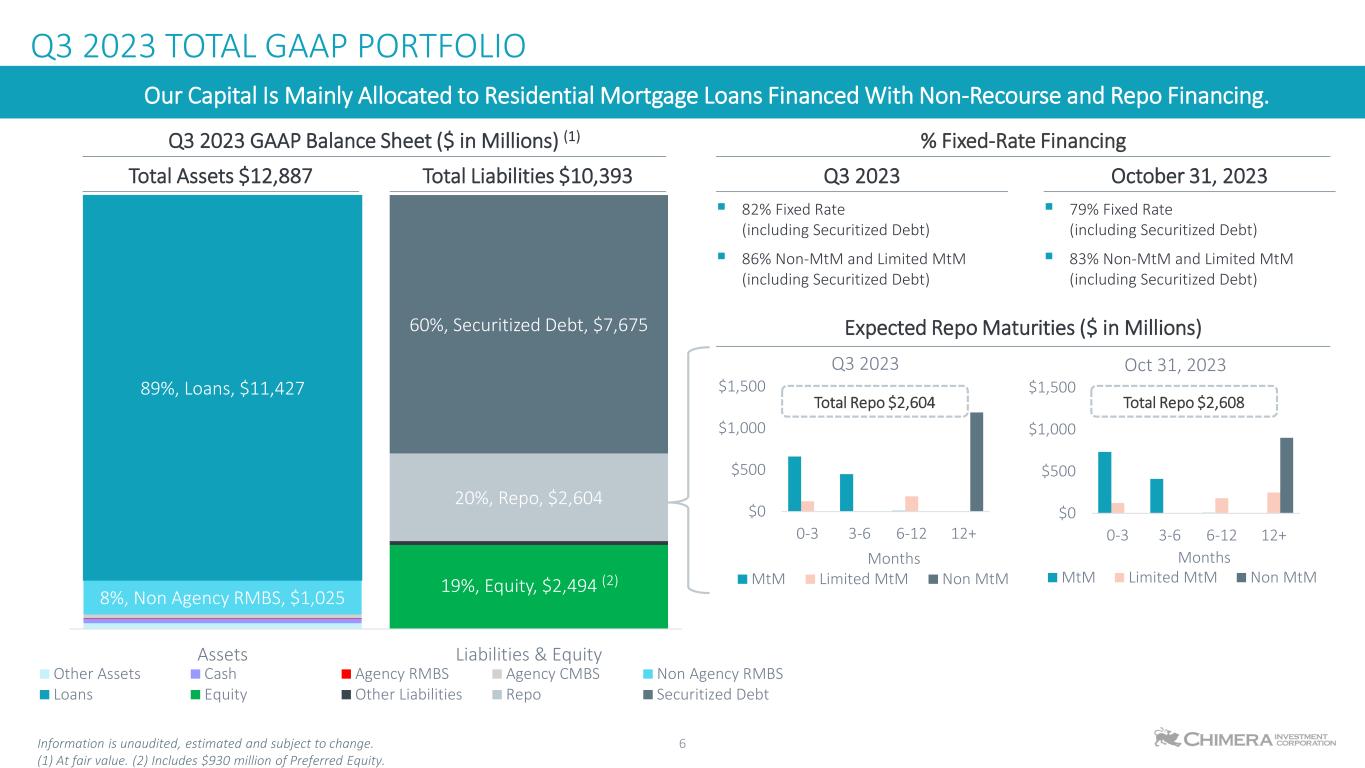

8%, Non Agency RMBS, $1,025 89%, Loans, $11,427 19%, Equity, $2,494 (2) 20%, Repo, $2,604 60%, Securitized Debt, $7,675 Assets Liabilities & Equity Other Assets Cash Agency RMBS Agency CMBS Non Agency RMBS Loans Equity Other Liabilities Repo Securitized Debt Q3 2023 TOTAL GAAP PORTFOLIO 6 Our Capital Is Mainly Allocated to Residential Mortgage Loans Financed With Non-Recourse and Repo Financing. Information is unaudited, estimated and subject to change. (1) At fair value. (2) Includes $930 million of Preferred Equity. 82% Fixed Rate (including Securitized Debt) 86% Non-MtM and Limited MtM (including Securitized Debt) $0 $500 $1,000 $1,500 0-3 3-6 6-12 12+ Months Q3 2023 MtM Limited MtM Non MtM % Fixed-Rate Financing Expected Repo Maturities ($ in Millions) Total Assets $12,887 Q3 2023 GAAP Balance Sheet ($ in Millions) (1) Total Liabilities $10,393 Q3 2023 October 31, 2023 79% Fixed Rate (including Securitized Debt) 83% Non-MtM and Limited MtM (including Securitized Debt) Total Repo $2,604 $0 $500 $1,000 $1,500 0-3 3-6 6-12 12+ Months Oct 31, 2023 MtM Limited MtM Non MtM Total Repo $2,608

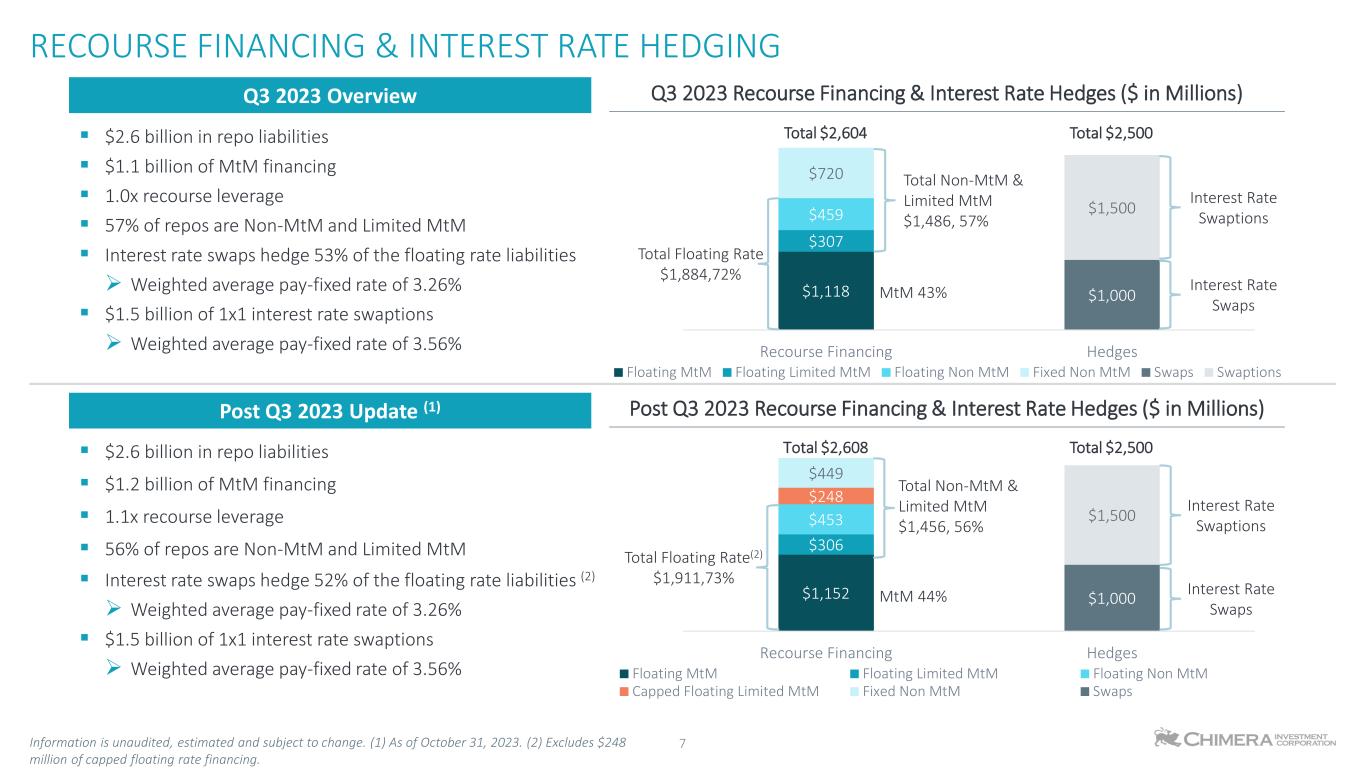

$1,118 $307 $459 $720 $1,000 $1,500 Recourse Financing Hedges Floating MtM Floating Limited MtM Floating Non MtM Fixed Non MtM Swaps Swaptions MtM 43% $1,152 $306 $453 $248 $449 $1,000 $1,500 Recourse Financing Hedges Floating MtM Floating Limited MtM Floating Non MtM Capped Floating Limited MtM Fixed Non MtM Swaps Total $2,500Total $2,608 Interest Rate Swaptions Interest Rate Swaps $2.6 billion in repo liabilities $1.1 billion of MtM financing 1.0x recourse leverage 57% of repos are Non-MtM and Limited MtM Interest rate swaps hedge 53% of the floating rate liabilities Weighted average pay-fixed rate of 3.26% $1.5 billion of 1x1 interest rate swaptions Weighted average pay-fixed rate of 3.56% $2.6 billion in repo liabilities $1.2 billion of MtM financing 1.1x recourse leverage 56% of repos are Non-MtM and Limited MtM Interest rate swaps hedge 52% of the floating rate liabilities (2) Weighted average pay-fixed rate of 3.26% $1.5 billion of 1x1 interest rate swaptions Weighted average pay-fixed rate of 3.56% RECOURSE FINANCING & INTEREST RATE HEDGING Information is unaudited, estimated and subject to change. (1) As of October 31, 2023. (2) Excludes $248 million of capped floating rate financing. Q3 2023 Overview Post Q3 2023 Update (1) 7 Total Floating Rate(2) $1,911,73% Total Non-MtM & Limited MtM $1,456, 56% MtM 44% Q3 2023 Recourse Financing & Interest Rate Hedges ($ in Millions) Total $2,500 Total Floating Rate $1,884,72% Interest Rate Swaptions Interest Rate Swaps Total $2,604 Post Q3 2023 Recourse Financing & Interest Rate Hedges ($ in Millions) Total Non-MtM & Limited MtM $1,486, 57%

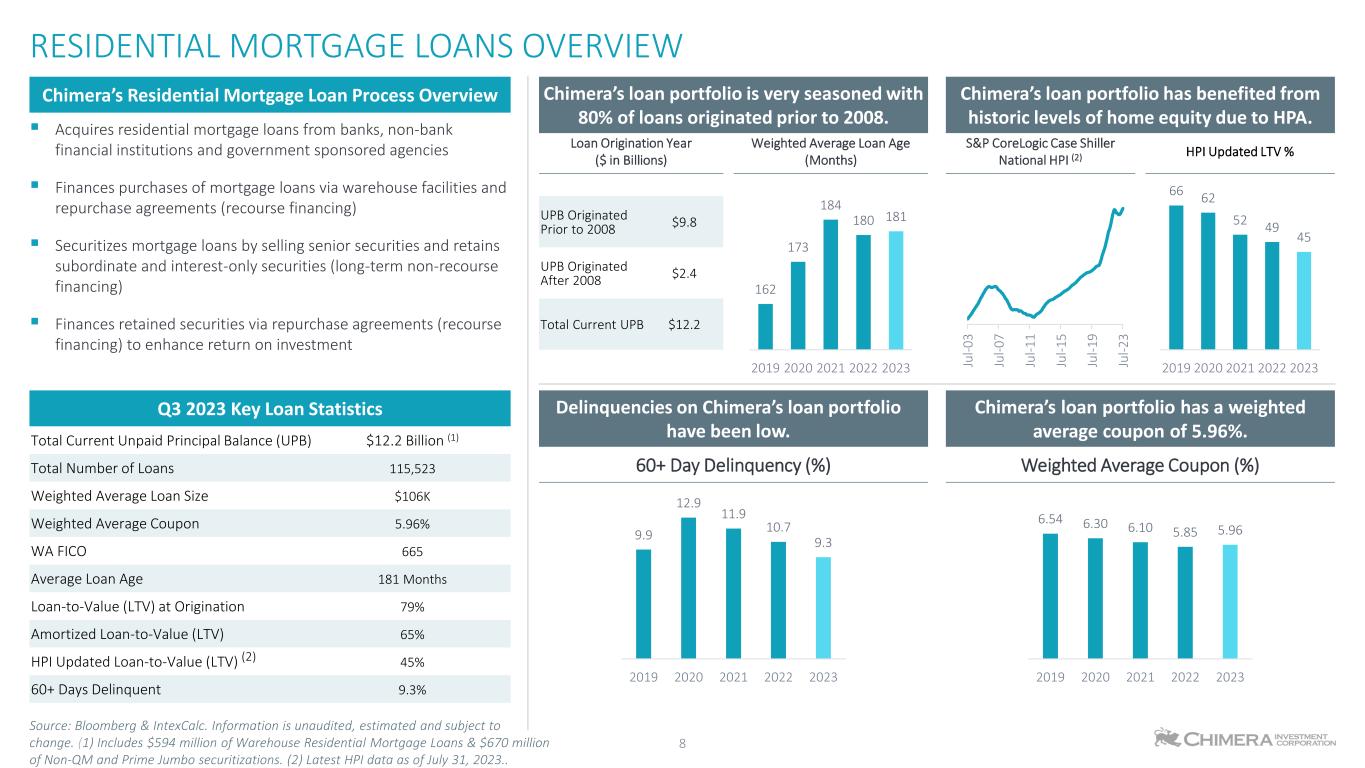

Chimera’s loan portfolio is very seasoned with 80% of loans originated prior to 2008. Acquires residential mortgage loans from banks, non-bank financial institutions and government sponsored agencies Finances purchases of mortgage loans via warehouse facilities and repurchase agreements (recourse financing) Securitizes mortgage loans by selling senior securities and retains subordinate and interest-only securities (long-term non-recourse financing) Finances retained securities via repurchase agreements (recourse financing) to enhance return on investment Chimera’s Residential Mortgage Loan Process Overview Q3 2023 Key Loan Statistics Total Current Unpaid Principal Balance (UPB) $12.2 Billion (1) Total Number of Loans 115,523 Weighted Average Loan Size $106K Weighted Average Coupon 5.96% WA FICO 665 Average Loan Age 181 Months Loan-to-Value (LTV) at Origination 79% Amortized Loan-to-Value (LTV) 65% HPI Updated Loan-to-Value (LTV) (2) 45% 60+ Days Delinquent 9.3% RESIDENTIAL MORTGAGE LOANS OVERVIEW UPB Originated Prior to 2008 $9.8 UPB Originated After 2008 $2.4 Total Current UPB $12.2 Chimera’s loan portfolio has benefited from historic levels of home equity due to HPA. 8 Source: Bloomberg & IntexCalc. Information is unaudited, estimated and subject to change. (1) Includes $594 million of Warehouse Residential Mortgage Loans & $670 million of Non-QM and Prime Jumbo securitizations. (2) Latest HPI data as of July 31, 2023.. Chimera’s loan portfolio has a weighted average coupon of 5.96%. Delinquencies on Chimera’s loan portfolio have been low. 162 173 184 180 181 2019 2020 2021 2022 2023 66 62 52 49 45 2019 2020 2021 2022 2023Ju l-0 3 Ju l-0 7 Ju l-1 1 Ju l-1 5 Ju l-1 9 Ju l-2 3 9.9 12.9 11.9 10.7 9.3 2019 2020 2021 2022 2023 6.54 6.30 6.10 5.85 5.96 2019 2020 2021 2022 2023 60+ Day Delinquency (%) Weighted Average Coupon (%) Weighted Average Loan Age (Months) Loan Origination Year ($ in Billions) S&P CoreLogic Case Shiller National HPI (2) HPI Updated LTV %

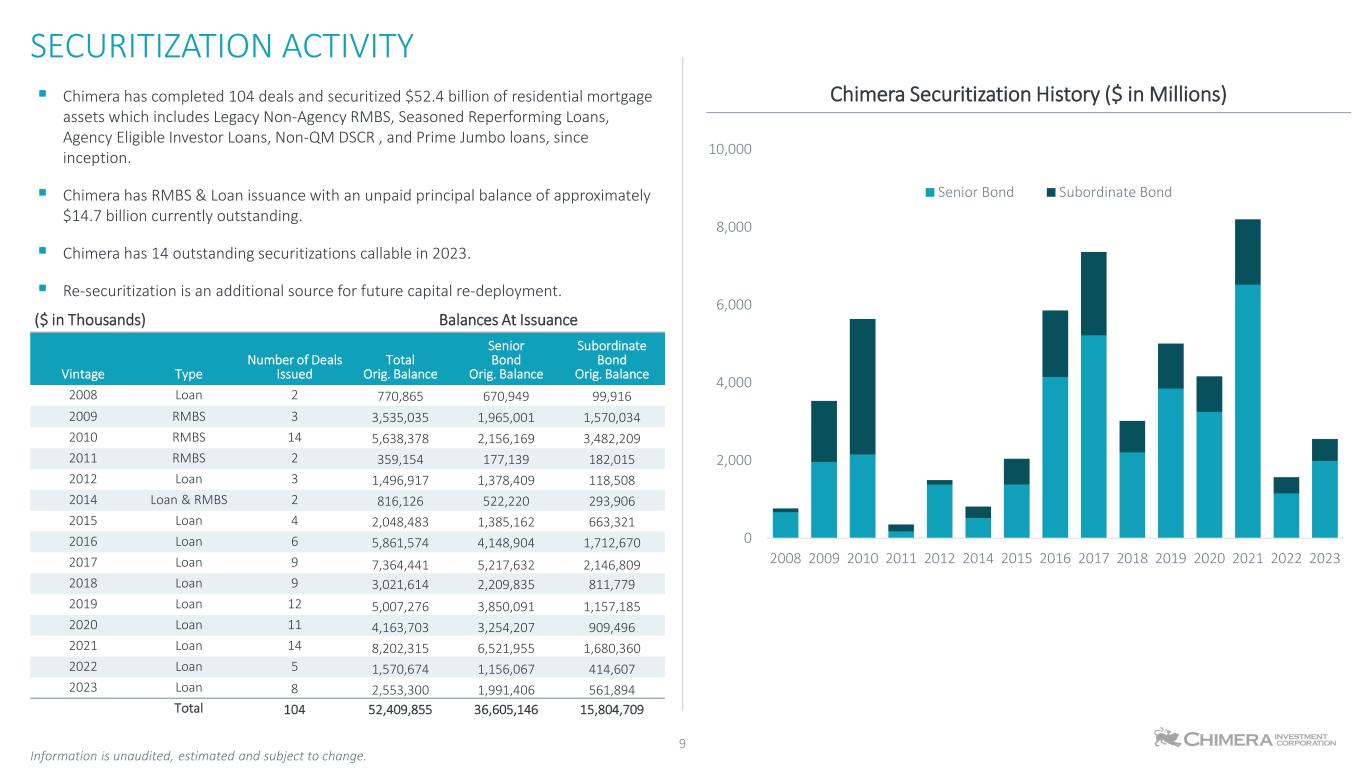

Chimera has completed 104 deals and securitized $52.4 billion of residential mortgage assets which includes Legacy Non-Agency RMBS, Seasoned Reperforming Loans, Agency Eligible Investor Loans, Non-QM DSCR , and Prime Jumbo loans, since inception. Chimera has RMBS & Loan issuance with an unpaid principal balance of approximately $14.7 billion currently outstanding. Chimera has 14 outstanding securitizations callable in 2023. Re-securitization is an additional source for future capital re-deployment. Type ($ in Thousands) Balances At Issuance Vintage Type Number of Deals Issued Total Orig. Balance Senior Bond Orig. Balance Subordinate Bond Orig. Balance 2008 Loan 2 770,865 670,949 99,916 2009 RMBS 3 3,535,035 1,965,001 1,570,034 2010 RMBS 14 5,638,378 2,156,169 3,482,209 2011 RMBS 2 359,154 177,139 182,015 2012 Loan 3 1,496,917 1,378,409 118,508 2014 Loan & RMBS 2 816,126 522,220 293,906 2015 Loan 4 2,048,483 1,385,162 663,321 2016 Loan 6 5,861,574 4,148,904 1,712,670 2017 Loan 9 7,364,441 5,217,632 2,146,809 2018 Loan 9 3,021,614 2,209,835 811,779 2019 Loan 12 5,007,276 3,850,091 1,157,185 2020 Loan 11 4,163,703 3,254,207 909,496 2021 Loan 14 8,202,315 6,521,955 1,680,360 2022 Loan 5 1,570,674 1,156,067 414,607 2023 Loan 8 2,553,300 1,991,406 561,894 Total 104 52,409,855 36,605,146 15,804,709 SECURITIZATION ACTIVITY 9 Information is unaudited, estimated and subject to change. 0 2,000 4,000 6,000 8,000 10,000 2008 2009 2010 2011 2012 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Senior Bond Subordinate Bond Chimera Securitization History ($ in Millions)

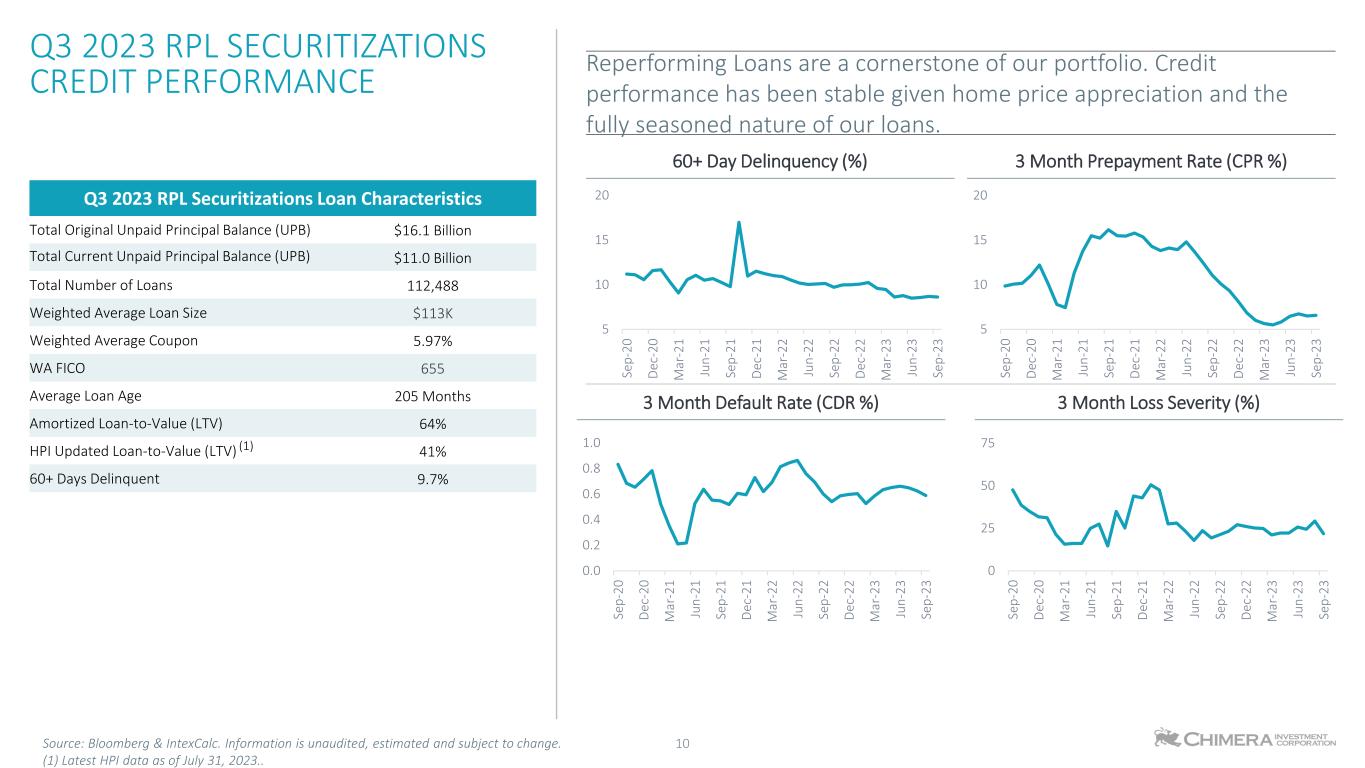

Reperforming Loans are a cornerstone of our portfolio. Credit performance has been stable given home price appreciation and the fully seasoned nature of our loans. Q3 2023 RPL SECURITIZATIONS CREDIT PERFORMANCE 10 Q3 2023 RPL Securitizations Loan Characteristics Total Original Unpaid Principal Balance (UPB) $16.1 Billion Total Current Unpaid Principal Balance (UPB) $11.0 Billion Total Number of Loans 112,488 Weighted Average Loan Size $113K Weighted Average Coupon 5.97% WA FICO 655 Average Loan Age 205 Months Amortized Loan-to-Value (LTV) 64% HPI Updated Loan-to-Value (LTV) (1) 41% 60+ Days Delinquent 9.7% Source: Bloomberg & IntexCalc. Information is unaudited, estimated and subject to change. (1) Latest HPI data as of July 31, 2023.. 5 10 15 20 Se p- 20 D ec -2 0 M ar -2 1 Ju n- 21 Se p- 21 D ec -2 1 M ar -2 2 Ju n- 22 Se p- 22 D ec -2 2 M ar -2 3 Ju n- 23 Se p- 23 5 10 15 20 Se p- 20 D ec -2 0 M ar -2 1 Ju n- 21 Se p- 21 D ec -2 1 M ar -2 2 Ju n- 22 Se p- 22 D ec -2 2 M ar -2 3 Ju n- 23 Se p- 23 0.0 0.2 0.4 0.6 0.8 1.0 Se p- 20 D ec -2 0 M ar -2 1 Ju n- 21 Se p- 21 D ec -2 1 M ar -2 2 Ju n- 22 Se p- 22 D ec -2 2 M ar -2 3 Ju n- 23 Se p- 23 0 25 50 75 Se p- 20 D ec -2 0 M ar -2 1 Ju n- 21 Se p- 21 D ec -2 1 M ar -2 2 Ju n- 22 Se p- 22 D ec -2 2 M ar -2 3 Ju n- 23 Se p- 23 60+ Day Delinquency (%) 3 Month Prepayment Rate (CPR %) 3 Month Default Rate (CDR %) 3 Month Loss Severity (%)

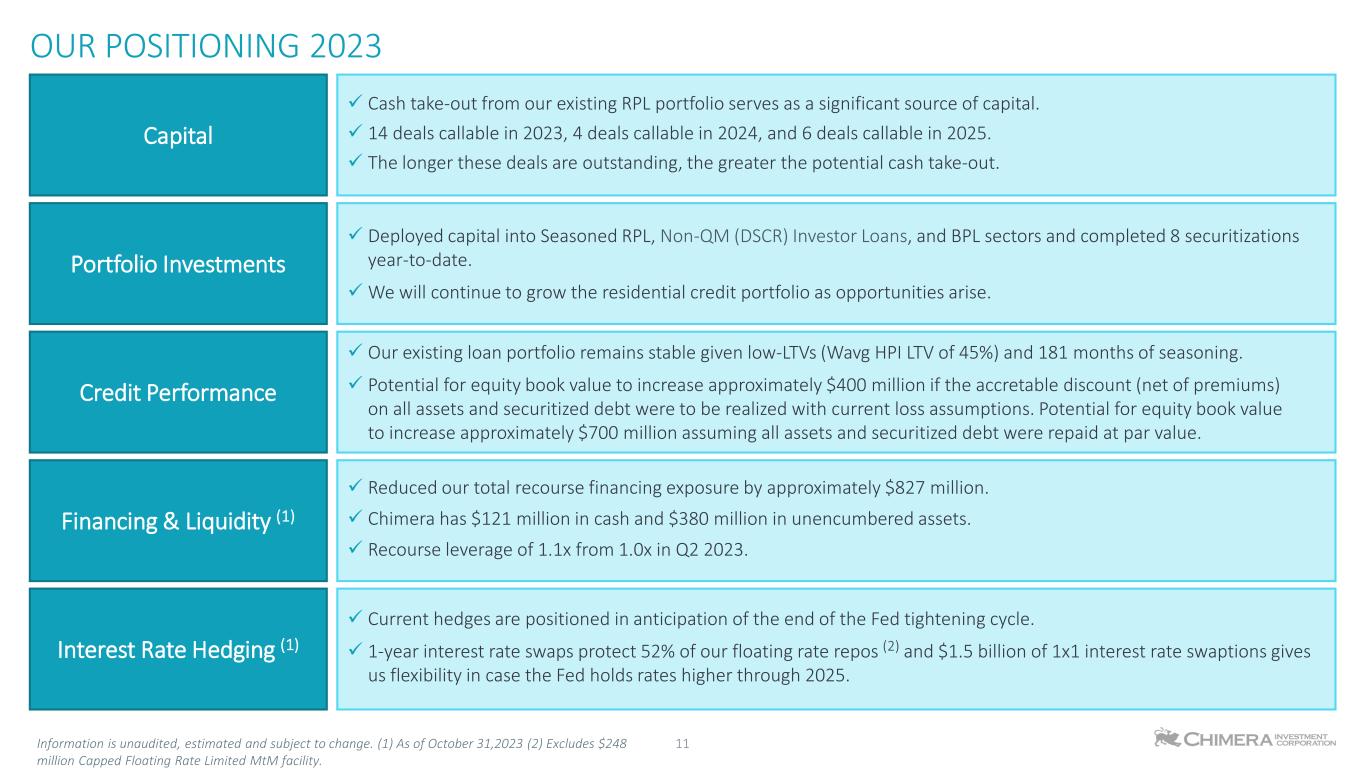

OUR POSITIONING 2023 11Information is unaudited, estimated and subject to change. (1) As of October 31,2023 (2) Excludes $248 million Capped Floating Rate Limited MtM facility. Portfolio Investments Cash take-out from our existing RPL portfolio serves as a significant source of capital. 14 deals callable in 2023, 4 deals callable in 2024, and 6 deals callable in 2025. The longer these deals are outstanding, the greater the potential cash take-out. Capital Deployed capital into Seasoned RPL, Non-QM (DSCR) Investor Loans, and BPL sectors and completed 8 securitizations year-to-date. We will continue to grow the residential credit portfolio as opportunities arise. Credit Performance Our existing loan portfolio remains stable given low-LTVs (Wavg HPI LTV of 45%) and 181 months of seasoning. Potential for equity book value to increase approximately $400 million if the accretable discount (net of premiums) on all assets and securitized debt were to be realized with current loss assumptions. Potential for equity book value to increase approximately $700 million assuming all assets and securitized debt were repaid at par value. Financing & Liquidity (1) Reduced our total recourse financing exposure by approximately $827 million. Chimera has $121 million in cash and $380 million in unencumbered assets. Recourse leverage of 1.1x from 1.0x in Q2 2023. Interest Rate Hedging (1) Current hedges are positioned in anticipation of the end of the Fed tightening cycle. 1-year interest rate swaps protect 52% of our floating rate repos (2) and $1.5 billion of 1x1 interest rate swaptions gives us flexibility in case the Fed holds rates higher through 2025.

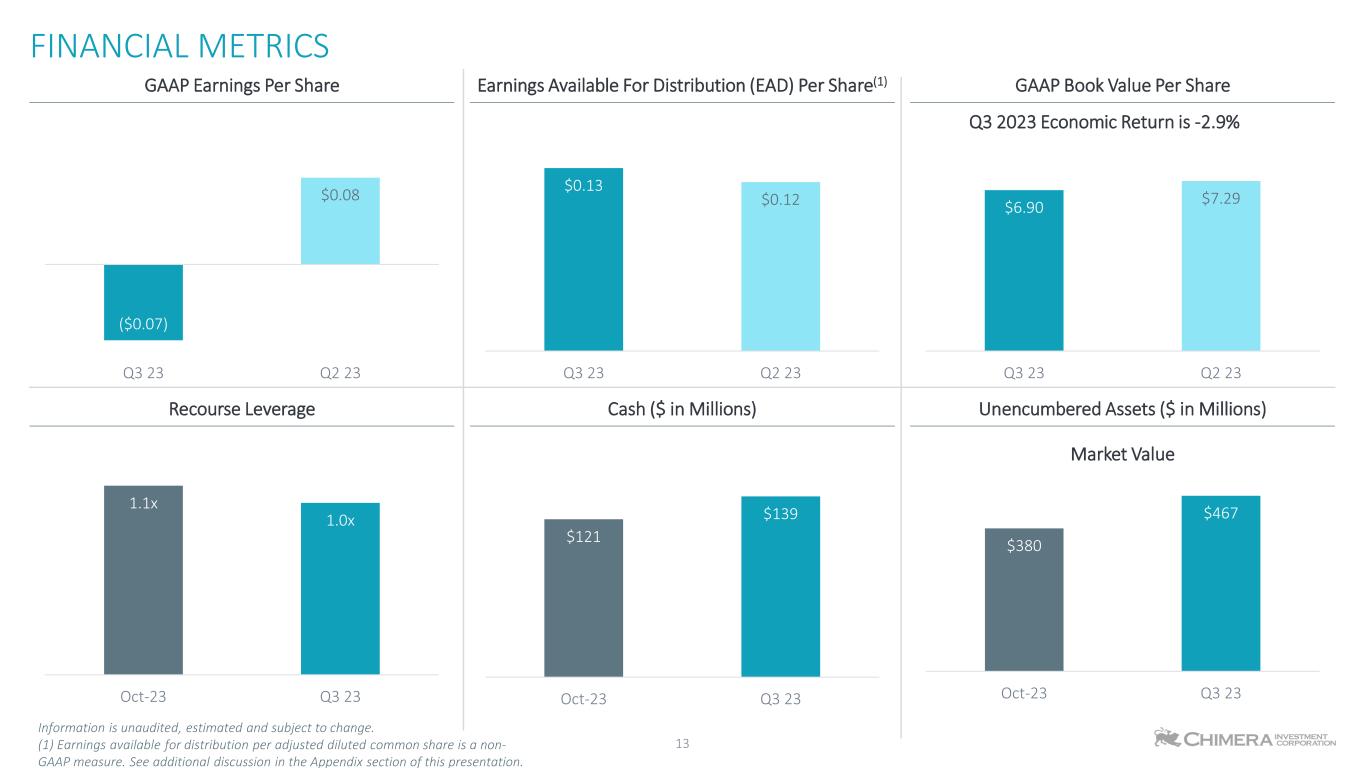

APPENDIX

13 FINANCIAL METRICS Information is unaudited, estimated and subject to change. (1) Earnings available for distribution per adjusted diluted common share is a non- GAAP measure. See additional discussion in the Appendix section of this presentation. ($0.07) $0.08 Q3 23 Q2 23 $0.13 $0.12 Q3 23 Q2 23 $6.90 $7.29 Q3 23 Q2 23 Q3 2023 Economic Return is -2.9% 1.1x 1.0x Oct-23 Q3 23 $121 $139 Oct-23 Q3 23 $380 $467 Oct-23 Q3 23 Market Value GAAP Earnings Per Share Earnings Available For Distribution (EAD) Per Share(1) GAAP Book Value Per Share Recourse Leverage Cash ($ in Millions) Unencumbered Assets ($ in Millions)

EARNINGS AVAILABLE FOR DISTRIBUTION Earnings available for distribution is a non-GAAP measure and is defined as GAAP net income excluding unrealized gains or losses on financial instruments carried at fair value with changes in fair value recorded in earnings, realized gains or losses on the sales of investments, gains or losses on the extinguishment of debt, changes in the provision for credit losses, other gains or losses on equity investments, and transaction expenses incurred. Transaction expenses are primarily comprised of costs only incurred at the time of execution of our securitizations and certain structured secured financing agreements and include costs such as underwriting fees, legal fees, diligence fees, bank fees and other similar transaction related expenses. These costs are all incurred prior to or at the execution of the transaction and do not recur. Recurring expenses, such as servicing fees, custodial fees, trustee fees and other similar ongoing fees are not excluded from earnings available for distribution. We believe that excluding these costs is useful to investors as it is generally consistent with our peer groups treatment of these costs in their non-GAAP measures presentation, mitigates period to period comparability issues tied to the timing of securitization and structured finance transactions, and is consistent with the accounting for the deferral of debt issue costs prior to the fair value election option made by us. In addition, we believe it is important for investors to review this metric which is consistent with how management internally evaluates the performance of the Company. Stock compensation expense charges incurred on awards to retirement eligible employees is reflected as an expense over a vesting period (generally 36 months) rather than reported as an immediate expense. Earnings available for distribution is the Economic net interest income, as defined previously, reduced by compensation and benefits expenses (adjusted for awards to retirement eligible employees), general and administrative expenses, servicing and asset manager fees, income tax benefits or expenses incurred during the period, as well as the preferred dividend charges. We view Earnings available for distribution as one measure of our investment portfolio's ability to generate income for distribution to common stockholders. Earnings available for distribution is one of the metrics, but not the exclusive metric, that our Board of Directors uses to determine the amount, if any, of dividends on our common stock. Other metrics that our Board of Directors may consider when determining the amount, if any, of dividends on our common stock include (among others) REIT taxable income, dividend yield, book value, cash generated from the portfolio, reinvestment opportunities and other cash needs. In addition, Earnings available for distribution is different than REIT taxable income and the determination of whether we have met the requirement to distribute at least 90% of our annual REIT taxable income (subject to certain adjustments) to our stockholders in order to maintain qualification as a REIT is not based on Earnings available for distribution. Therefore, Earnings available for distribution should not be considered as an indication of our REIT taxable income, a guaranty of our ability to pay dividends, or as a proxy for the amount of dividends we may pay. We believe Earnings available for distribution as described above helps us and investors evaluate our financial performance period over period without the impact of certain transactions. Therefore, Earnings available for distribution should not be viewed in isolation and is not a substitute for net income or net income per basic share computed in accordance with GAAP. In addition, our methodology for calculating Earnings available for distribution may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and accordingly, our Earnings available for distribution may not be comparable to the Earnings available for distribution reported by other REITs. 14

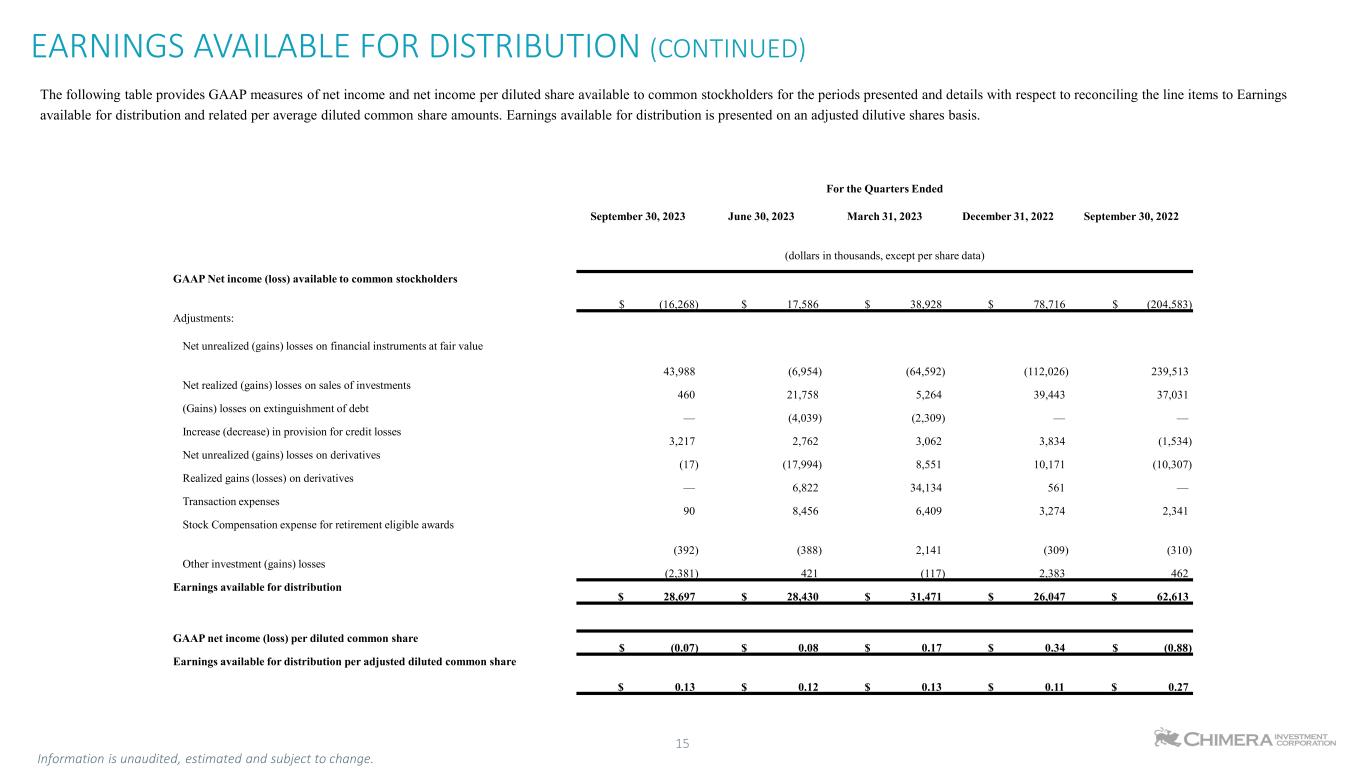

EARNINGS AVAILABLE FOR DISTRIBUTION (CONTINUED) 15 The following table provides GAAP measures of net income and net income per diluted share available to common stockholders for the periods presented and details with respect to reconciling the line items to Earnings available for distribution and related per average diluted common share amounts. Earnings available for distribution is presented on an adjusted dilutive shares basis. Information is unaudited, estimated and subject to change. For the Quarters Ended September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 (dollars in thousands, except per share data) GAAP Net income (loss) available to common stockholders $ (16,268) $ 17,586 $ 38,928 $ 78,716 $ (204,583) Adjustments: Net unrealized (gains) losses on financial instruments at fair value 43,988 (6,954) (64,592) (112,026) 239,513 Net realized (gains) losses on sales of investments 460 21,758 5,264 39,443 37,031 (Gains) losses on extinguishment of debt — (4,039) (2,309) — — Increase (decrease) in provision for credit losses 3,217 2,762 3,062 3,834 (1,534) Net unrealized (gains) losses on derivatives (17) (17,994) 8,551 10,171 (10,307) Realized gains (losses) on derivatives — 6,822 34,134 561 — Transaction expenses 90 8,456 6,409 3,274 2,341 Stock Compensation expense for retirement eligible awards (392) (388) 2,141 (309) (310) Other investment (gains) losses (2,381) 421 (117) 2,383 462 Earnings available for distribution $ 28,697 $ 28,430 $ 31,471 $ 26,047 $ 62,613 GAAP net income (loss) per diluted common share $ (0.07) $ 0.08 $ 0.17 $ 0.34 $ (0.88) Earnings available for distribution per adjusted diluted common share $ 0.13 $ 0.12 $ 0.13 $ 0.11 $ 0.27 For the Quarters Ended September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 (dollars in thousands, except per share data) GAAP Net income (loss) available to common stockholders $ (16,268) $ 17,586 $ 38,928 $ 78,716 $ (204,583) Adjustments: Net unrealized (gains) losses on financial instruments at fair value 43,988 (6,954) (64,592) (112,026) 239,513 Net realized (gains) losses on sales of investments 460 21,758 5,264 39,443 37,031 (Gains) losses on extinguishment of debt — (4,039) (2,309) — — Increase (decrease) in provision for credit losses 3,217 2,762 3,062 3,834 (1,534) Net unrealized (gains) losses on derivatives (17) (17,994) 8,551 10,171 (10,307) Realized gains (losses) on derivatives — 6,822 34,1 4 561 — Transaction expenses 90 8,456 6,409 3,274 2,341 Stock Compensation expense for retirement eligible awards (392) (388) 2,141 (309) (310) Other investment (gains) losses (2,381) 421 (117) 2,383 462 Earnings available for distribution $ 28,697 $ 28,430 $ 31,471 $ 26,047 $ 62,613 GAAP net income (loss) per diluted common share $ (0.07) $ 0.08 $ 0.17 $ 0.34 $ (0.88) Earnings available for distribution per adjusted diluted common share $ 0.13 $ 0.12 $ 0.13 $ 0.11 $ 0.27

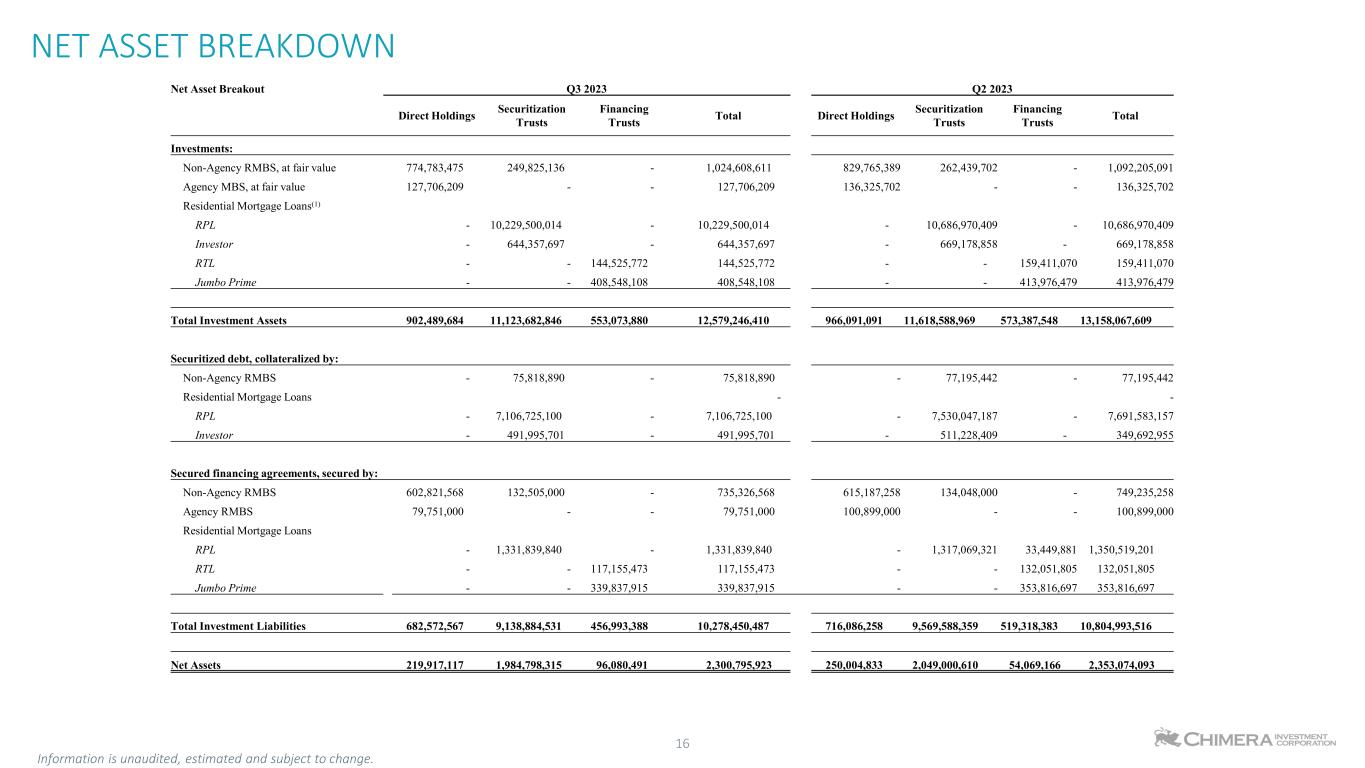

NET ASSET BREAKDOWN 16 Net Asset Breakout Q3 2023 Q2 2023 Direct Holdings Securitization Trusts Financing Trusts Total Direct Holdings Securitization Trusts Financing Trusts Total Investments: Non-Agency RMBS, at fair value 774,783,475 249,825,136 - 1,024,608,611 829,765,389 262,439,702 - 1,092,205,091 Agency MBS, at fair value 127,706,209 - - 127,706,209 136,325,702 - - 136,325,702 Residential Mortgage Loans(1) RPL - 10,229,500,014 - 10,229,500,014 - 10,686,970,409 - 10,686,970,409 Investor - 644,357,697 - 644,357,697 - 669,178,858 - 669,178,858 RTL - - 144,525,772 144,525,772 - - 159,411,070 159,411,070 Jumbo Prime - - 408,548,108 408,548,108 - - 413,976,479 413,976,479 Total Investment Assets 902,489,684 11,123,682,846 553,073,880 12,579,246,410 966,091,091 11,618,588,969 573,387,548 13,158,067,609 Securitized debt, collateralized by: Non-Agency RMBS - 75,818,890 - 75,818,890 - 77,195,442 - 77,195,442 Residential Mortgage Loans - - RPL - 7,106,725,100 - 7,106,725,100 - 7,530,047,187 - 7,691,583,157 Investor - 491,995,701 - 491,995,701 - 511,228,409 - 349,692,955 Secured financing agreements, secured by: Non-Agency RMBS 602,821,568 132,505,000 - 735,326,568 615,187,258 134,048,000 - 749,235,258 Agency RMBS 79,751,000 - - 79,751,000 100,899,000 - - 100,899,000 Residential Mortgage Loans RPL - 1,331,839,840 - 1,331,839,840 - 1,317,069,321 33,449,881 1,350,519,201 RTL - - 117,155,473 117,155,473 - - 132,051,805 132,051,805 Jumbo Prime - - 339,837,915 339,837,915 - - 353,816,697 353,816,697 Total Investment Liabilities 682,572,567 9,138,884,531 456,993,388 10,278,450,487 716,086,258 9,569,588,359 519,318,383 10,804,993,516 Net Assets 219,917,117 1,984,798,315 96,080,491 2,300,795,923 250,004,833 2,049,000,610 54,069,166 2,353,074,093 Information is unaudited, estimated and subject to change.

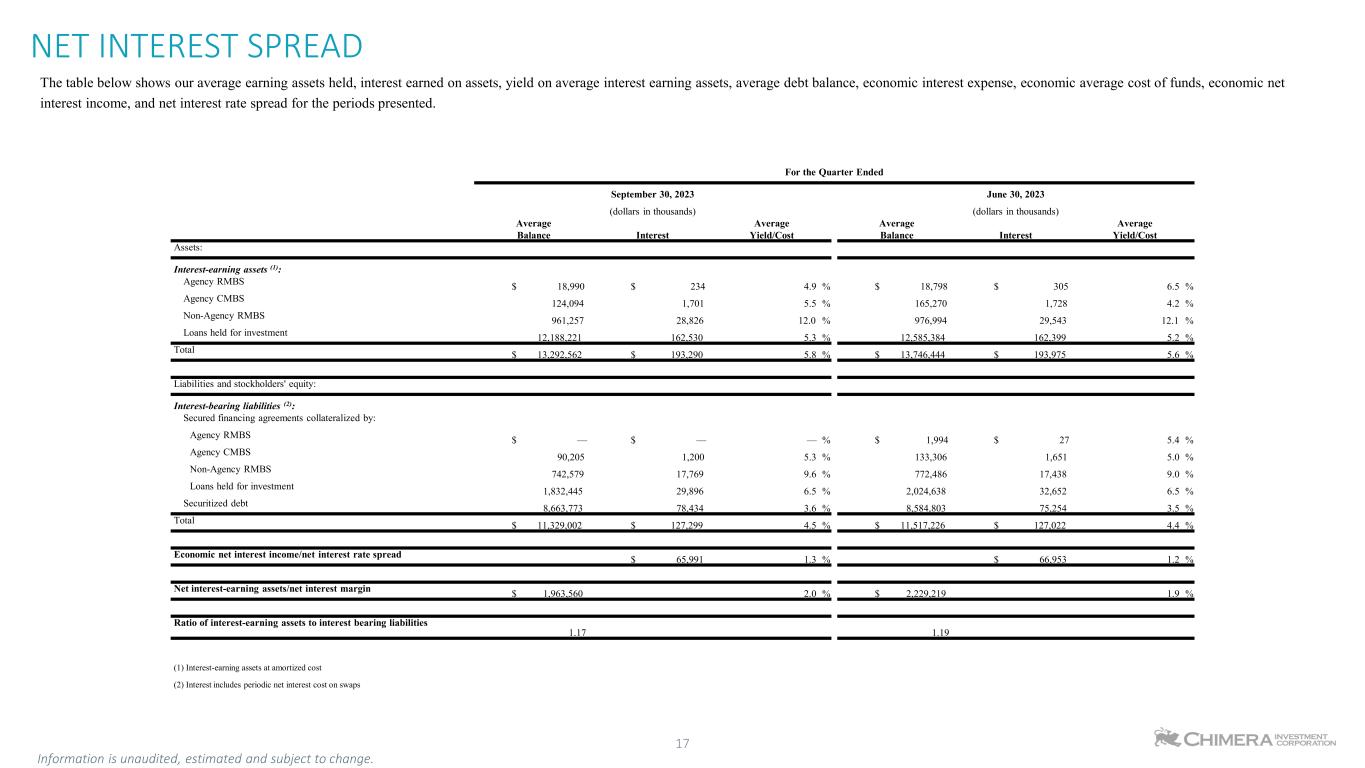

NET INTEREST SPREAD 17 The table below shows our average earning assets held, interest earned on assets, yield on average interest earning assets, average debt balance, economic interest expense, economic average cost of funds, economic net interest income, and net interest rate spread for the periods presented. For the Quarter Ended September 30, 2023 June 30, 2023 (dollars in thousands) (dollars in thousands) Average Balance Interest Average Yield/Cost Average Balance Interest Average Yield/Cost Assets: Interest-earning assets (1): Agency RMBS $ 18,990 $ 234 4.9 % $ 18,798 $ 305 6.5 % Agency CMBS 124,094 1,701 5.5 % 165,270 1,728 4.2 % Non-Agency RMBS 961,257 28,826 12.0 % 976,994 29,543 12.1 % Loans held for investment 12,188,221 162,530 5.3 % 12,585,384 162,399 5.2 % Total $ 13,292,562 $ 193,290 5.8 % $ 13,746,444 $ 193,975 5.6 % Liabilities and stockholders' equity: Interest-bearing liabilities (2): Secured financing agreements collateralized by: Agency RMBS $ — $ — — % $ 1,994 $ 27 5.4 % Agency CMBS 90,205 1,200 5.3 % 133,306 1,651 5.0 % Non-Agency RMBS 742,579 17,769 9.6 % 772,486 17,438 9.0 % Loans held for investment 1,832,445 29,896 6.5 % 2,024,638 32,652 6.5 % Securitized debt 8,663,773 78,434 3.6 % 8,584,803 75,254 3.5 % Total $ 11,329,002 $ 127,299 4.5 % $ 11,517,226 $ 127,022 4.4 % Economic net interest income/net interest rate spread $ 65,991 1.3 % $ 66,953 1.2 % Net interest-earning assets/net interest margin $ 1,963,560 2.0 % $ 2,229,219 1.9 % Ratio of interest-earning assets to interest bearing liabilities 1.17 1.19 (1) Interest-earning assets at amortized cost (2) Interest includes periodic net interest cost on swaps Information is unaudited, estimated and subject to change.

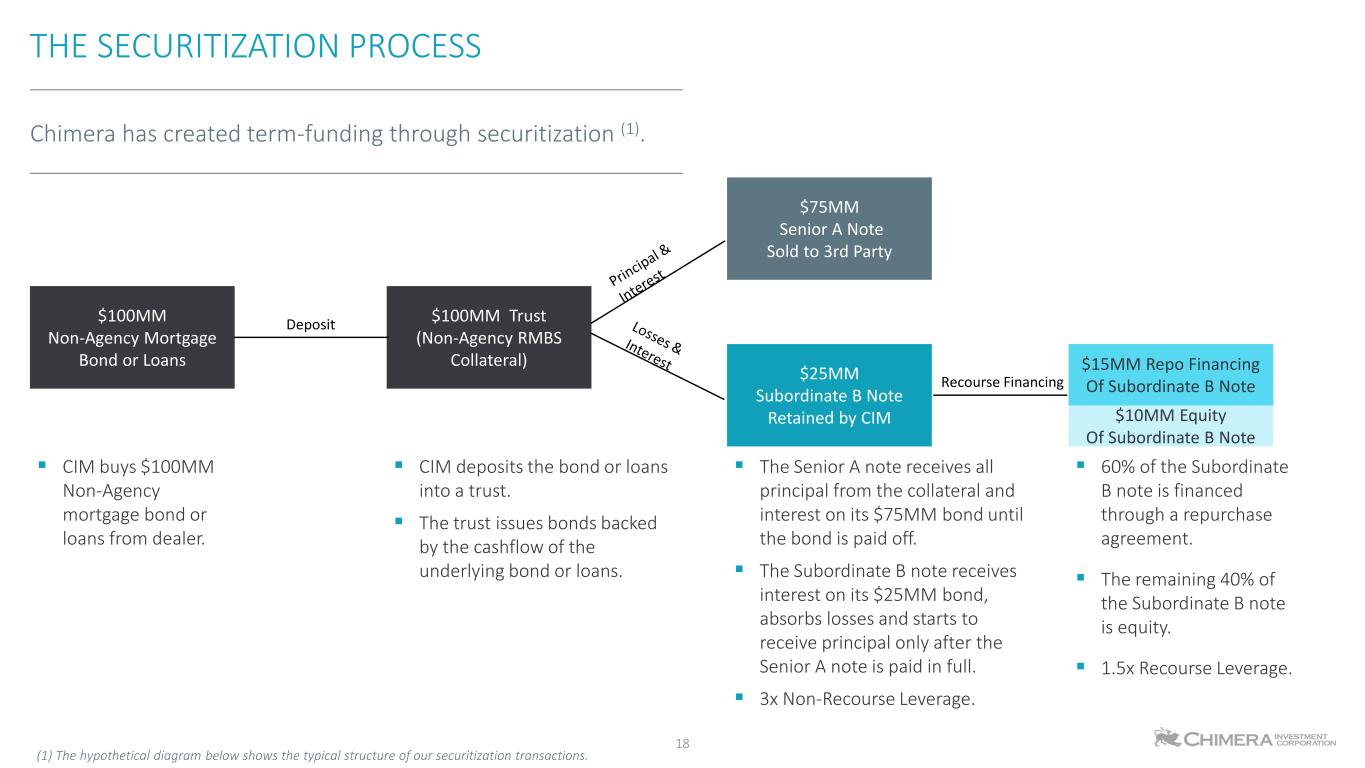

Chimera has created term-funding through securitization (1). THE SECURITIZATION PROCESS CIM buys $100MM Non-Agency mortgage bond or loans from dealer. CIM deposits the bond or loans into a trust. The trust issues bonds backed by the cashflow of the underlying bond or loans. The Senior A note receives all principal from the collateral and interest on its $75MM bond until the bond is paid off. The Subordinate B note receives interest on its $25MM bond, absorbs losses and starts to receive principal only after the Senior A note is paid in full. 3x Non-Recourse Leverage. $100MM Non-Agency Mortgage Bond or Loans $100MM Trust (Non-Agency RMBS Collateral) $75MM Senior A Note Sold to 3rd Party $25MM Subordinate B Note Retained by CIM Deposit 18 Recourse Financing $15MM Repo Financing Of Subordinate B Note $10MM Equity Of Subordinate B Note 60% of the Subordinate B note is financed through a repurchase agreement. The remaining 40% of the Subordinate B note is equity. 1.5x Recourse Leverage. (1) The hypothetical diagram below shows the typical structure of our securitization transactions.

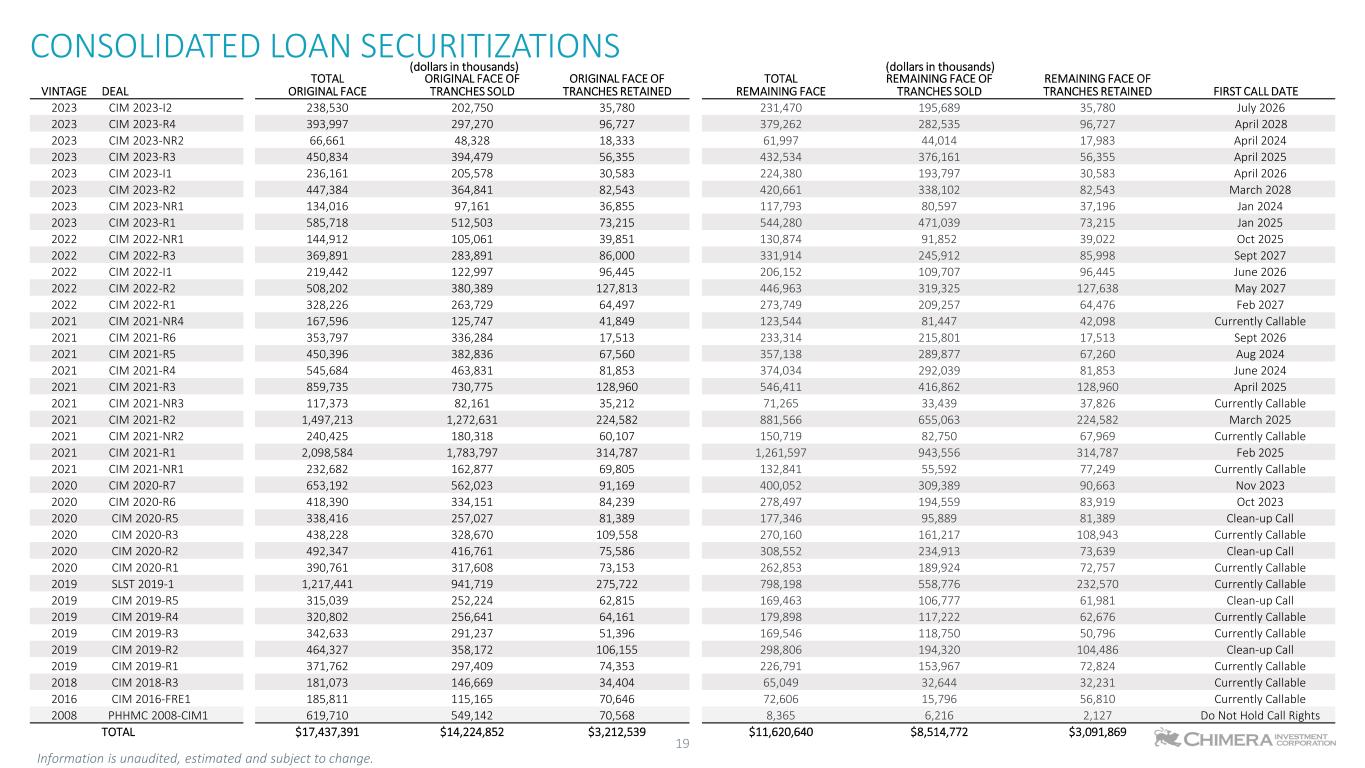

CONSOLIDATED LOAN SECURITIZATIONS 19 VINTAGE DEAL TOTAL ORIGINAL FACE ORIGINAL FACE OF TRANCHES SOLD ORIGINAL FACE OF TRANCHES RETAINED TOTAL REMAINING FACE REMAINING FACE OF TRANCHES SOLD REMAINING FACE OF TRANCHES RETAINED FIRST CALL DATE 2023 CIM 2023-I2 238,530 202,750 35,780 231,470 195,689 35,780 July 2026 2023 CIM 2023-R4 393,997 297,270 96,727 379,262 282,535 96,727 April 2028 2023 CIM 2023-NR2 66,661 48,328 18,333 61,997 44,014 17,983 April 2024 2023 CIM 2023-R3 450,834 394,479 56,355 432,534 376,161 56,355 April 2025 2023 CIM 2023-I1 236,161 205,578 30,583 224,380 193,797 30,583 April 2026 2023 CIM 2023-R2 447,384 364,841 82,543 420,661 338,102 82,543 March 2028 2023 CIM 2023-NR1 134,016 97,161 36,855 117,793 80,597 37,196 Jan 2024 2023 CIM 2023-R1 585,718 512,503 73,215 544,280 471,039 73,215 Jan 2025 2022 CIM 2022-NR1 144,912 105,061 39,851 130,874 91,852 39,022 Oct 2025 2022 CIM 2022-R3 369,891 283,891 86,000 331,914 245,912 85,998 Sept 2027 2022 CIM 2022-I1 219,442 122,997 96,445 206,152 109,707 96,445 June 2026 2022 CIM 2022-R2 508,202 380,389 127,813 446,963 319,325 127,638 May 2027 2022 CIM 2022-R1 328,226 263,729 64,497 273,749 209,257 64,476 Feb 2027 2021 CIM 2021-NR4 167,596 125,747 41,849 123,544 81,447 42,098 Currently Callable 2021 CIM 2021-R6 353,797 336,284 17,513 233,314 215,801 17,513 Sept 2026 2021 CIM 2021-R5 450,396 382,836 67,560 357,138 289,877 67,260 Aug 2024 2021 CIM 2021-R4 545,684 463,831 81,853 374,034 292,039 81,853 June 2024 2021 CIM 2021-R3 859,735 730,775 128,960 546,411 416,862 128,960 April 2025 2021 CIM 2021-NR3 117,373 82,161 35,212 71,265 33,439 37,826 Currently Callable 2021 CIM 2021-R2 1,497,213 1,272,631 224,582 881,566 655,063 224,582 March 2025 2021 CIM 2021-NR2 240,425 180,318 60,107 150,719 82,750 67,969 Currently Callable 2021 CIM 2021-R1 2,098,584 1,783,797 314,787 1,261,597 943,556 314,787 Feb 2025 2021 CIM 2021-NR1 232,682 162,877 69,805 132,841 55,592 77,249 Currently Callable 2020 CIM 2020-R7 653,192 562,023 91,169 400,052 309,389 90,663 Nov 2023 2020 CIM 2020-R6 418,390 334,151 84,239 278,497 194,559 83,919 Oct 2023 2020 CIM 2020-R5 338,416 257,027 81,389 177,346 95,889 81,389 Clean-up Call 2020 CIM 2020-R3 438,228 328,670 109,558 270,160 161,217 108,943 Currently Callable 2020 CIM 2020-R2 492,347 416,761 75,586 308,552 234,913 73,639 Clean-up Call 2020 CIM 2020-R1 390,761 317,608 73,153 262,853 189,924 72,757 Currently Callable 2019 SLST 2019-1 1,217,441 941,719 275,722 798,198 558,776 232,570 Currently Callable 2019 CIM 2019-R5 315,039 252,224 62,815 169,463 106,777 61,981 Clean-up Call 2019 CIM 2019-R4 320,802 256,641 64,161 179,898 117,222 62,676 Currently Callable 2019 CIM 2019-R3 342,633 291,237 51,396 169,546 118,750 50,796 Currently Callable 2019 CIM 2019-R2 464,327 358,172 106,155 298,806 194,320 104,486 Clean-up Call 2019 CIM 2019-R1 371,762 297,409 74,353 226,791 153,967 72,824 Currently Callable 2018 CIM 2018-R3 181,073 146,669 34,404 65,049 32,644 32,231 Currently Callable 2016 CIM 2016-FRE1 185,811 115,165 70,646 72,606 15,796 56,810 Currently Callable 2008 PHHMC 2008-CIM1 619,710 549,142 70,568 8,365 6,216 2,127 Do Not Hold Call Rights TOTAL $17,437,391 $14,224,852 $3,212,539 $11,620,640 $8,514,772 $3,091,869 Information is unaudited, estimated and subject to change. (dollars in thousands) (dollars in thousands)

20